Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

A Study on Investor’s Awareness on ELSS Tax Saving Schemes

Authors: Dr. Savitha V

DOI Link: https://doi.org/10.22214/ijraset.2023.53918

Certificate: View Certificate

Abstract

Investor’s awareness is a term used in investor relation, by public companies and similar bodies, to describe how well their investors and the investment market in general, know their business. Equity-linked saving scheme is an open-ended equity diversified fund, which provides a tax benefit to investors under section 80 C of the Income Tax Act, 1961. ELSS funds invest in equity and market capitalization across different sectors to achieve attractive returns. Being an equity fund, returns are dependent on the price movements of the stocks invested in and the market as a whole. ELSS funds have a lock-in period of 3 years from the date of investment. The objective of this study is to know the investors awareness on ELSS tax saving scheme. The sample size is limited to 150 respondents. Both primary and secondary data was used for the study. Primary data was collected through a structured questionnaire and secondary data was collected from books, journals and web sites. For analysing the collected data statistical tools such frequency, percentage, ranking method were used. The study concluded that the awareness and benefits of ELSS tax saving schemes.

Introduction

I. INTRODUCTION

In order to encourage individual investors to develop equity investment culture, the then finance minister Shri. S.B.Chavan, in his budget speech on 28th February 1989, introduced a new mutual fund scheme called the ‘Equity Linked Savings Scheme’ (ELSS).The ELSS funds incentivized the small investors with a lower income tax obligation, depending on the amount invested in ELSS funds, during the year. ELSS mutual funds therefore are conceived to be one of the means of reducing the income tax burden of the investor and so appropriately, referred to as Tax Saving Mutual Funds. For an initial period till 31st March 1991, ELSS investments were eligible for deduction benefit of Rs.10,000. From the financial year 1991-92 onwards, the tax incentive was modified to a tax rebate benefit, under Section 88 of the Income Tax Act, with Rs.10, 000, remaining the eligible investment amount. From the financial year 2005-06, the tax incentive reverted back to deduction benefit, under Section 80C of the Income Tax Act, with an eligible investment amount going up to Rs.1, 00,000. The eligible investment for deduction benefit from the financial year 2014-15 was further increased to Rs.1, 50,000.

An ELSS fund or an equity-linked savings scheme is the only kind of mutual funds eligible for tax deductions under the provisions of Section 80C of the Income Tax Act, 1961. You can claim a tax rebate of up to Rs 1, 50,000 and save up to Rs 46,800 a year in taxes by investing in ELSS mutual funds.

A. Features of ELSS Funds

- They offer tax deductions of up to Rs 1,50,000 a year under Section 80C provision

- ELSS funds come with a lock-in period of three years, and there are no provisions to make a premature exit

- You can invest any amount in ELSS, there is no upper capping, while the minimum investable amount varies across fund houses

- ELSS funds are the only tax-saving investment with the potential to offer inflation beating returns.

- Investing in ELSS funds gives you the twin benefits of tax deductions and wealth creation

- The portfolio of an ELSS fund mostly consists of equities, while they have some exposure towards fixed-income securities as well.

B. Advantages of ELSS fund

- Shortest lock-in period: The 3-year lock-in period of ELSS mutual funds is the shortest among other tax-saving investment options. For example, PPF has a minimum maturity period of 15 years. Hence, tax-saver fund schemes are more liquid.

- Potential to generate high returns: Contrary to ELSS mutual funds, other tax-saving investment options, like bank fixed deposits and PPF, generate a fixed income. Conversely, ELSS funds invest in stocks of different companies, and their NAV fluctuates accordingly. An uptick in prices of such underlying securities can yield sizeable returns for investors.

- Tax benefit: Investments up to Rs.1.5 lakh are eligible for tax deductions as per the provisions of the Income Tax Act.

Investment modes: Two routes via which individuals can invest in the best ELSS mutual funds are – Systematic Investment Plan and lump-sum. SIP allows individuals to invest in a scheme by paying fixed instalments at regular intervals (monthly, quarterly, annually, etc.). On the flip side, the lump-sum method allows investors to allocate the available funds to an ELSS mutual fund scheme in one go.

II. REVIEW OF LITERATURE

- Mayur Rao et.al (2023), they conducted a research on investor’s perception and preference towards tax saving financial products. The objectives of the study are to measure awareness of financial product available for tax saving among selected people and to identify preferred Tax saving financial products among the selected. The study concluded that the tax-saving is an important part of financial planning and analysing the perception of investors towards different options available to save tax and the most preferred financial product.

- Varsha Singhania (2021), have explained on awareness of investment in tax saving products. The objective of the study are i) to know the respondents awareness on the Tax planning and Tax deductions ii) to know the sources of Awareness about the Investment in Tax Saving Products to the respondents iii) to know the preference of Tax Saving Investments options of the respondents and to know the preference of respondents on the basis of Lock-down period of Investment, Returns and Taxability. The study concluded that the respondents have basic knowledge and awareness about various tax saving schemes u/s 80C to 80U.

- Swati M. Gurav (2021), studied on equity-linked saving scheme (ELSS) and its performance analysis. The objective of the study are i) to analyse the performance of selected equity-linked saving schemes in India ii) To associate the performance selected equity-linked saving schemes in India using performance measures like Sharpe ratio and Treynor ratio. This study provides some awareness on mutual fund performance so as to help the common investors in taking the rational investment decisions for allocating their resources in the correct mutual fund schemes.

- Bhuvaneswari C (2020) discussed on investor’s perception towards equity/tax saving mutual funds. The objectives of the study are to find the investors perception towards the equity and tax saving mutual funds and to study the performance of the Equity/Tax saving mutual funds from the investor’s point of view. The study concluded that the organization should be cautious in making investment towards the various financial instruments which safeguard the interest of the investors.

- Richa Pathak (2018) conducted a study on performance evaluation of ELSS mutual funds with special reference to growth funds. The purpose of the study is to analyse the performance of select ELSS mutual fund available in the market and to suggest a suitable mutual fund scheme which helps them in achieving their investment objectives. The study concluded that ELSS funds are in huge demand as it is suitable for salaried people who want to save income tax under 80 cc but they have lock in period of 3 years.

III. OBJECTIVE OF THE STUDY

The objective of the study is to know the investor’s awareness on ELSS tax saving scheme.

IV. STATEMENT OF THE PROBLEM

The purpose of the study is to analyse the investor’s awareness on ELSS tax saving scheme and to suggest an ELSS tax saving scheme which helps them in achieving their investment objectives.

V. SCOPE OF THE STUDY

- This study will be helpful to those investor’s who are planning to invest in ELSS funds.

- This study will give an insight to the techniques/methods which are used to judge the ELSS tax saving schemes.

VI. LIMITATIONS OF THE STUDY

- The sample size is limited to 150 respondents.

- The study is limited to Mandya city only.

VII. RESEARCH METHODOLOGY

- Sample Design

- Sample size: The sample size is limited to 150 respondents.

- Sampling technique: For the study, simple random sampling techniques were used.

B. Data Collection

Both primary and secondary data was used for the study. Primary data was collected through a structured questionnaire and secondary data was collected from books, journals and web sites.

C. Tools for Analysis

For analysing the collected data statistical tools such frequency, percentage, ranking method was used.

VIII. DATA ANALYSIS AND INTRPRETATION

Table No. 1: Demographic Profile of the Respondents

|

Sl. No. |

Particulars |

No. of respondents

|

Percentage |

|

1. |

Gender

|

95 55 |

63.33 36.67 |

|

2 |

Age

|

30 55 65 |

20.00 36.67 43.33 |

|

3. |

Educational qualification

|

72 58 20 |

48.00 38.67 13.33 |

|

4. |

Occupation

|

25 65 45 15 |

16.67 43.33 30.00 10.00 |

Table No. 1. Represents the demographic profile of respondents, 95 male respondents and 55 female respondents are investing in ELSS tax saving schemes, it represents that compared to female respondents; highest number of male respondents are investing in ELSS tax saving schemes, Based on age pattern of respondents 30 respondents are below 20 years and 55 respondents are between 20 to 40 years, 65 respondents are above 40 years are invest in ELSS tax saving schemes and 72 respondents educational qualification is post-graduation and 58 respondents belongs to graduates and 20 respondents belongs to matriculation. The higher number of post graduates respondents are investing in ELSS tax saving schemes, In the context of occupation 25 respondents are belongs to private employees, 65 respondents are belongs to Government employees, 45 respondents are belongs to businessman and 15 respondents are belongs to others.

Table No. 2: Awareness level of ELSS tax saving schemes

|

Particulars |

No of respondents |

Percentage |

|

Very High |

30 |

20.00 |

|

High |

35 |

23.33 |

|

Moderate |

60 |

40.00 |

|

Low |

15 |

10.00 |

|

Very low |

10 |

6.67 |

|

Total |

150 |

100 |

Table No. 2. Represents the investor awareness level of ELSS tax saving schemes, 60 respondents are moderately aware about ELSS tax saving schemes, followed by 30 respondents are very high, 35 respondents are high, 15 respondents are low, 10 respondents are very low aware in ELSS tax saving schemes.

Majority of respondents are having moderately aware about ELSS tax saving schemes in Mandya city.

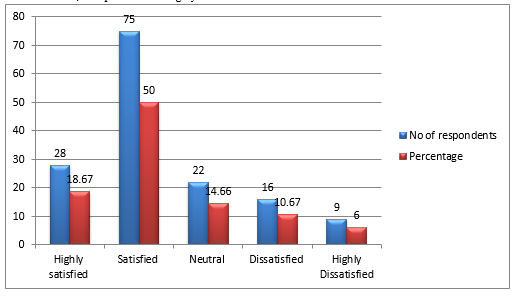

Table No. 3: Satisfaction from Investment in ELSS tax saving schemes

|

Particulars |

No of respondents |

Percentage |

|

Highly satisfied |

28 |

18.67 |

|

Satisfied |

75 |

50.00 |

|

Neutral |

22 |

14.66 |

|

Dissatisfied |

16 |

10.67 |

|

Highly Dissatisfied |

9 |

6.00 |

|

Total |

150 |

100 |

Table No. 3. Represents the level of satisfaction from investment in ELSS tax saving schemes. 75 respondents are satisfied with investment in ELSS tax saving schemes, followed by 28 respondents are highly satisfied, 22 respondents are Neutral, 16 respondents are dissatisfied, 9 respondents are highly dissatisfied.

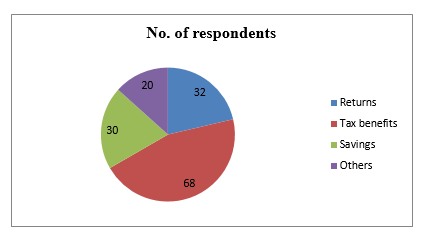

Table No. 4: Reason for investing in ELSS tax saving schemes

|

Particulars |

No. of respondents |

Percentage |

|

Returns |

32 |

21.33 |

|

Tax benefits |

68 |

45.33 |

|

Savings |

30 |

20.00 |

|

Others |

20 |

13.34 |

|

Total |

150 |

100 |

Table No. 4. Represents the reason for investing in ELSS tax saving schemes. 68 respondents are investing in ELSS for tax benefit purpose, followed by 32 respondents are returns, 30 respondents are Savings, 20 respondents are other purpose.

IX. FINDINGS

- Highest numbers of male respondents are investing in ELSS tax saving schemes

- Most of respondents are moderately aware about ELSS tax saving schemes.

- Majority of respondents are satisfied with investment in ELSS tax saving schemes.

- Most of respondents are invested in ELSS for tax benefit purpose.

X. SUGGESTIONS

- Government should provide more tax benefit schemes to female investors.

- More awareness about ELSS tax saving schemes should be undertaken.

- Security for ELSS investors should be provided by the Government.

- High returns should be provide for the investors.

Conclusion

The study concluded that Equity Linked Savings Scheme (ELSS) schemes invest a majority of the fund corpus in equity and equity-related instruments and feature a lock-in period of 3 years. After this period is over, an ELSS scheme converts into an open-ended scheme. Under section 80C of the Income Tax Act 1961, investments of up to Rs.1.5 lakh in ELSS funds are eligible for a tax deduction. Most of the respondents are using Equity Linked Savings Scheme (ELSS) for tax deduction purpose. There are no readymade solutions when it comes to investing. While one scheme might be perfect for an investor, another plan may not be the ideal option for them. Hence, individuals must identify their investment objectives before buying ELSS units.

References

[1] Bhuvaneswari C “A study on investor’s perception towards equity/tax saving mutual funds” CARE Journal of Applied Research ISSN 2321-4090. [2] Mayur Rao et.al “A study on investor’s perception and preference towards tax saving financial products” ISSN 2349-9249, Volume 10, Issue 2, February 2023. [3] Richa Pathak “A study on performance evaluation of ELSS mutual funds with special reference to growth funds” ISSN-2349-5162, Volume 5, Issue 5, May 2018. [4] Swati M. Gurav “A study on equity-linked saving scheme (ELSS) and its performance analysis” ISSN: 2320-2882, Volume 9, Issue 7 July 2021. [5] Varsha Singhania “A study on awareness of investment in tax saving products” Volume 9, Special Issue September 2021 RONC-MPQOPCE ISSN: 2349-7300.

Copyright

Copyright © 2023 Dr. Savitha V . This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET53918

Publish Date : 2023-06-09

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online