Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Customer Perception On E-Banking Services of Public and Private Sector Banks in Hyderabad Region

Authors: Papunuka Lakshmi, Dr. Thamilselvan. R

DOI Link: https://doi.org/10.22214/ijraset.2022.42627

Certificate: View Certificate

Abstract

E-Banking is the use of electronic means in banker-customer and banker-company interactions and internal banking operations to simplify and improve banking services. \"Paperless, faceless, cashless\" is the recognized role and motto of the cashless economy. Various types of electronic payments are available as part of the promotion of cashless and paperless transactions and the transition of the economy to a cashless society and economy. Various types of electronic payment systems include electronic banking, debit cards, credit cards and electronic wallets. Today, almost all banks are adopting ICT as a means of improving the quality of service of their banking services. Attempts have been made to evaluate the services provided by banks through electronic banking services. Electronic banking services offer a lot of convenience, customer orientation, enhanced quality of service and cost efficiency. We used a structured survey to collect relevant data from our customers. This report examines customer perception of electronic banking services provided by public and private banks in the Hyderabad region. The study sample size is 102. Data is collected from both primary and secondary information. This report uses non-stochastic sampling techniques and the most appropriate sampling method is used for the survey.

Introduction

I. INTRODUCTION

In the present scenario online services have become an added feature in the banking sector. Electronic banking or Internet banking allows customers to conduct financial transactions on a secure website. Credit goes to internet that provided ultimate ease to the customers at their door step. Electronic banking allows people to perform all the banking related activities such as money transfer, past transactional information, cash withdrawals and deposits etc with a just one click of a mouse. Clients can easily check the account balance every day just by visiting the website of their bank. This provides the place and time utility to people provided if one has Internet access. Electronic banking also eliminates unnecessary waste, which an organization incurs in the form of office supplies. This facet has also helped in meeting the social concerns. However, using internet for money transaction is never been free from risk. More importantly, security is always been an issue with Internet transactions. Despite several counter measures taken by the banks in the form of information encryption, firewalls, encoding etc but still reluctance prevails in relaying totally at Electronic banking especially in developing countries like India. This led to the foundation of this study. The core purpose of this research study was to figure out the most critical factors having an impact on customer perception towards electronic banking services in India. In Hyderabad city, many of banks introduce electronic banking. By introducing electronic banking, its help to build reputation and increasing the customers towards banks. Electronic banking, also known as internet banking, online banking or virtual banking, is an electronic payment system that enables customers of a bank or other financial institution to conduct a range of financial transactions through the financial institution's website.

A. Industry Profile

A bank could even be a financial organization that gives banking and other monetary administrations to their clients. A bank is usually understood as an establishment which gives key financial administrations like tolerating stores and giving advances. The banks additionally alluded as a framework gave by the bank which offers money the executives administrations for supporters, revealing the exchanges of their records and portfolios, for the duration of the day. The banking industry in India, shouldn't just be without problem however it should be ready to meet the new difficulties presented by the technology and thus the opposite external and inner variables. from the most recent thirty years, India's banking system has a few exceptional accomplishments surprisingly. The Banks are the premier members of the economic system in India.

B. Statement Of The Problem

Today, financial services particularly banking services are facing with fast changes in information technology, increased internet penetration and usage of smart phone for digital transactions, unbalanced economic environment, intensive competition among public, private and foreign sector banks, consolidation and merger of public sector banks, tech-savvy customers, etc. create more challenges in the banking industry in India. Financial service sector particularly banking sector is facing with those issues and experiences not seen in their history. Presently, electronic banking is emerged as a competitive arena for future banking services that makes the banks to provide quality of services with more features and lower costs than conventional banking to their customers. This study is to identify and analyse the electronic services provided by the public and private sector banks in Hyderabad region. The practical contributions of this study would assist the public and private sector banks to improve their electronic banking services, which will increase the level of satisfaction and service continuance intention towards electronic banking services. This research is, therefore, important to provide the solutions with respect to electronic services issues, increase customer satisfaction and service continuance intention of customers of public and private sector banks in Hyderabad region.

C. Objectives Of The Study

- Primary Objective

a. The primary objective of the study is “To examine the customer perception on e-banking systems related to public and private banks, particularly the banks located in Hyderabad.”

2. Secondary Objectives

a. To study the status of e-banking culture among the private and public bank customers

b. To check the factors that influence the customer perception into e-banking system

c. To gather and analyse the private and public bank customers' opinion on e-banking systems

D. Limitations Of The Study

- As the geographical area of the study is limited to Hyderabad area only, Hence the findings and conclusion has its own limitations.

- A convenience sample method was used for the data collection, which makes the results not readily generalizable.

II. REVIEW OF LITERATURE

Abid (2016) has made an attempt to studied the e- payment system that has typically changed the traditional payment system in India. In this study is based on secondary data sources. The paper talked about different electronic payment methods provided by Reserve Bank of India and Indian banks and their level of transactions in terms of value and volume. It was found that the e-payment systems registered high volumes in 2014-2015, following the determined efforts made by the RBI for movements to e-payments. Similarly, transactions processed by the paper-based clearing systems had shown a continuous decline both in terms of value and volume. Overall, the payment and settlement systems posted a higher growth of 27.1 percent in volume and a lower growth of 5.4 per cent in value in 2014-2015 in relation to the previous year.

Jalil (2014) studied that customer trust was the main important variable that positively and significantly affected all the other variables. They examined the perception of Malaysian consumers towards online banking. The finding showed that security, trust and website itself had a significant relationship with the consumer’s perception towards online banking in a Malaysia.

Khan (2017) examined that a better integration of online payment systems with the present financial and telecommunication infrastructure was needed for a prosperous future of this payment mode. They also found that future work may be directed towards the legalisation of various factors responsible for contributing in the effective adoption of online payment systems all over the world. Madhava K (2020) A try has been made by evaluating the services concentrated by banks through the e-banking services. The e-banking service carries lot of convenience, customer centricity, increased service quality and cost effectiveness. This paper scrutinizes the patron satisfaction on the Electronic Banking Services of Public Sector and Private Sector Banks in Puducherry Region. The outcome of the learning shows that customers of Public Sector Banks have lesser perception of the various dimensions of eservice quality compared with the private sector Banks.

Yogeswaran G (2015) this study was undertaken on topic customer perception towards amenities provided by public sector and private banks- A comparative study. The services of ICICI Bank and SBI Banks are taken into consideration. According to this study, public sector banks face tough competition from private sector banks for the quality of their services. Public sector banks should focus on providing their clients with up-to-date information on the new services they provide. The study also reveals that, public sector banks need to change their policies, customer service standards and service efficiency.

III. RESEARCH METHODOLOGY

A. Research Design

This survey is exploratory in nature, and a self-designed survey-based survey was conducted to gain insight into customer perceptions of electronic banking services provided by public and private sector banks in the Hyderabad region. The purpose of exploratory research is simply to look up research questions, not to provide definitive and definitive solutions to existing problems. This type of investigation is usually done to investigate a problem that has not been explicitly investigated, but it helps the investigator to better understand the problem. The research is conducted to analyse THE CUSTOMER PERCEPTION ON E – BANKING SERVICES OF PUBLIC AND PRIVATE SECTOR BANKS IN HYDERABAD REGION.

B. Sampling Technique

The sampling technique used here is convenience sampling method. A convenience sample is one of the main types of non-probability sampling methods. A convenience sample is made up of people who are easy to reach.

C. Sources Of Data

Data collection is the term used to describe a process of preparing and collecting data. The data collection made through a well framed questionnaire.

- The primary data had been collected with the help of self-structured questionnaire on THE CUSTOMER PERCEPTION ON E – BANKING SERVICES OF PUBLIC AND PRIVATE SECTOR BANKS IN HYDERABAD REGION.

- The secondary data had been collected from books, magazines, journals and articles.

D. Structure Of The Questionnaire

Questionnaire was divided into two sections. First part contains general information and the second part contains questions related to electronic banking services, questionnaire was prepared by using Likert scale.

E. Sample Size

The sample size for the project is 102. Data has been collected from 102 respondents.

F. Hypothesis/Analytical Tools

The following are a set of imaginary questions framed in order to conduct hypothesis tests using chi square test and Anova. These questions are framed in the form of quantitative data as the survey was of qualitative data.

- Chi-square test: (Significance level 0.5)

H0: There is an impact of demographic variables on customers intention towards the use of electronic banking services.

H1: There is no impact of demographic variables on customers intention towards the use of electronic banking services.

Output

|

Age * most_used_EBanking_services_by_you_ Crosstabulation |

||||||||||

|

Count |

||||||||||

|

|

most_used_EBanking_services_by_you_ |

Total |

||||||||

|

Mobile Banking |

ATM |

Smart Cards |

EFT (Electronic Funds Transfer) System |

|||||||

|

Age |

Below 20 years |

9 |

14 |

4 |

1 |

28 |

||||

|

21 - 30 years |

23 |

22 |

3 |

7 |

55 |

|||||

|

31 - 40 years |

5 |

7 |

0 |

2 |

14 |

|||||

|

Above 41 years |

1 |

1 |

1 |

2 |

5 |

|||||

|

Total |

38 |

44 |

8 |

12 |

102 |

|||||

|

Chi-Square Test |

|

|||||||||

|

|

Value |

df |

Asymptotic Significance (2-sided) |

|

||||||

|

Pearson Chi-Square |

11.144a |

9 |

.266 |

|

||||||

|

Likelihood Ratio |

11.212 |

9 |

.261 |

|

||||||

|

Linear-by-Linear Association |

1.663 |

1 |

.197 |

|

||||||

|

N of Valid Cases |

102 |

|

|

|

||||||

|

a. 9 cells (56.3%) have expected count less than 5. The minimum expected count is .39. |

|

|||||||||

- Conclusion: Since p value 0.39 is greater than 0.05, null hypothesis is accepted and alternate hypothesis is rejected. Hence, There is an impact of demographic variables on customers intention towards the use of electronic banking services.

2. Chi-square test

H0: There are some factors like physical aspects, efficiency, reliability, security and privacy, trust which may influence the customer perception into the e-banking system.

H2: The factors doesnot influence the customer perception into e- banking system.

Output

|

Income_for_month_ * Type_of_account_ Crosstabulation |

||||||

|

Count |

||||||

|

|

Type_of_account_ |

Total |

||||

|

Savings account |

Current account |

Fixed deposit account |

Demat account |

|||

|

Income_for_month_ |

Below Rs.20,000 |

45 |

1 |

1 |

0 |

47 |

|

Rs.20,001-40,000 |

21 |

5 |

1 |

0 |

27 |

|

|

Rs.40,001-60,000 |

5 |

7 |

0 |

0 |

12 |

|

|

Rs.60,001-80,000 |

5 |

2 |

1 |

0 |

8 |

|

|

Above Rs.80,001 |

6 |

1 |

0 |

1 |

8 |

|

|

Total |

82 |

16 |

3 |

1 |

102 |

|

|

Chi-Square Test |

|||

|

|

Value |

df |

Asymptotic Significance (2-sided) |

|

Pearson Chi-Square |

39.024a |

12 |

.000 |

|

Likelihood Ratio |

29.678 |

12 |

.003 |

|

Linear-by-Linear Association |

10.426 |

1 |

.001 |

|

N of Valid Cases |

102 |

|

|

|

a. 14 cells (70.0%) have expected count less than 5. The minimum expected count is .08. |

|||

- Conclusion: Since p value 0.08 is greater than 0.05, null hypothesis is accepted and alternate hypothesis is rejected. Hence, there are some factors like physical aspects, efficiency, reliability, security and privacy, trust which may influence the customer perception into the e-banking system.

3. Anova Test

H0: The private and public bank customers have positive opinion in promoting the e-banking systems to other customers.

H3: The private and public bank customers doesnot have a positive opinion in promoting the e- banking system to other customers.

Output

|

ANOVA |

|||||

|

Gender |

|||||

|

|

Sum of Squares |

df |

Mean Square |

F |

Sig. |

|

Between Groups |

.912 |

4 |

.228 |

.937 |

.446 |

|

Within Groups |

23.608 |

97 |

.243 |

|

|

|

Total |

24.520 |

101 |

|

|

|

|

Multiple Comparisons |

||||||

|

Dependent Variable: Gender |

||||||

|

Tukey HSD |

||||||

|

(I) Electronic_bankingservices_are_moredependable_ |

(J) Electronic_bankingservices_are_moredependable_ |

Mean Difference (I-J) |

Std. Error |

Sig. |

95% Confidence Interval |

|

|

Lower Bound |

Upper Bound |

|||||

|

Strongly agree |

Agree |

-.024 |

.132 |

1.000 |

-.39 |

.34 |

|

Neither agree nor disagree |

-.058 |

.131 |

.992 |

-.42 |

.31 |

|

|

Disagree |

-.152 |

.364 |

.993 |

-1.16 |

.86 |

|

|

Strongly disagree |

-.452 |

.243 |

.347 |

-1.13 |

.22 |

|

|

Agree |

Strongly agree |

.024 |

.132 |

1.000 |

-.34 |

.39 |

|

Neither agree nor disagree |

-.034 |

.116 |

.998 |

-.36 |

.29 |

|

|

Disagree |

-.129 |

.359 |

.996 |

-1.13 |

.87 |

|

|

Strongly disagree |

-.429 |

.236 |

.370 |

-1.08 |

.23 |

|

|

Neither agree nor disagree |

Strongly agree |

.058 |

.131 |

.992 |

-.31 |

.42 |

|

Agree |

.034 |

.116 |

.998 |

-.29 |

.36 |

|

|

Disagree |

-.095 |

.358 |

.999 |

-1.09 |

.90 |

|

|

Strongly disagree |

-.395 |

.235 |

.452 |

-1.05 |

.26 |

|

|

Disagree |

Strongly agree |

.152 |

.364 |

.993 |

-.86 |

1.16 |

|

Agree |

.129 |

.359 |

.996 |

-.87 |

1.13 |

|

|

Neither agree nor disagree |

.095 |

.358 |

.999 |

-.90 |

1.09 |

|

|

Strongly disagree |

-.300 |

.413 |

.950 |

-1.45 |

.85 |

|

|

Strongly disagree |

Strongly agree |

.452 |

.243 |

.347 |

-.22 |

1.13 |

|

Agree |

.429 |

.236 |

.370 |

-.23 |

1.08 |

|

|

Neither agree nor disagree |

.395 |

.235 |

.452 |

-.26 |

1.05 |

|

|

Disagree |

.300 |

.413 |

.950 |

-.85 |

1.4 |

|

|

Gender |

||

|

Tukey HSDa,b |

||

|

Electronic_bankingservices_are_moredependable_ |

N |

Subset for alpha = 0.05 |

|

1 |

||

|

Strongly agree |

23 |

1.35 |

|

Agree |

35 |

1.37 |

|

Neither agree nor disagree |

37 |

1.41 |

|

Disagree |

2 |

1.50 |

|

Strongly disagree |

5 |

1.80 |

|

Sig. |

|

.488 |

|

Means for groups in homogeneous subsets are displayed. |

||

|

a. Uses Harmonic Mean Sample Size = 6.257. |

||

|

b. The group sizes are unequal. The harmonic mean of the group sizes is used. Type I error levels are not guaranteed. |

||

- Conclusion: Since p value 0.448 is greater than 0.05, null hypothesis is accepted and alternate hypothesis is rejected. Hence, the private and public bank customers have positive opinion in promoting the e-banking systems to other customers.

IV. DATA ANALYSIS

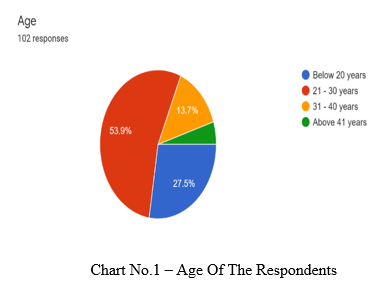

A. Table – Age Of The Respondents

|

AGE |

NO. OF RESPONDENTS |

PERCENTAGE |

|

BELOW 20 YEARS |

28 |

27.5 |

|

21-30 YEARS |

55 |

53.9 |

|

31-40 YEARS |

14 |

13.7 |

|

ABOVE 41 YEARS |

5 |

4.9 |

|

|

102 |

100 |

Source: Primary Data

- Interpretation: From the above table shows that age of the respondents below 20 years are 27.5%, 21-30 years are of 53.9%, 31-40 years are of 13.7% and above 40 years are of 4.9 %.

- Inference: Majority of the respondents are from the age 21-30 years with 53.9%.

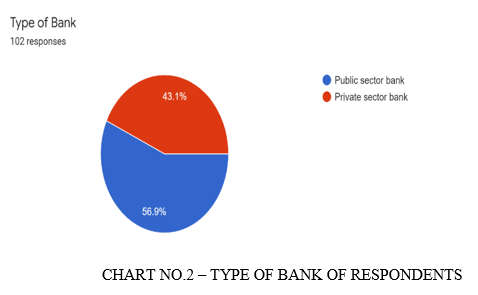

B. Table – Type Of Bank Of Respondents

|

TYPE OF BANK |

NO. OF RESPONDENTS |

PERCENTAGE |

|

PUBLIC SECTOR BANK |

58 |

56.9 |

|

PRIVATE SECTOR BANK |

44 |

43.1 |

|

TOTAL |

102 |

100 |

Source: Primary Data

- Interpretation: From the table above shows that type of bank of the respondents public sector bank are of 56.9% and private sector bank are of 43.1%.

- Inference: Majority of the respondents are of public sector bank with 56.9%.

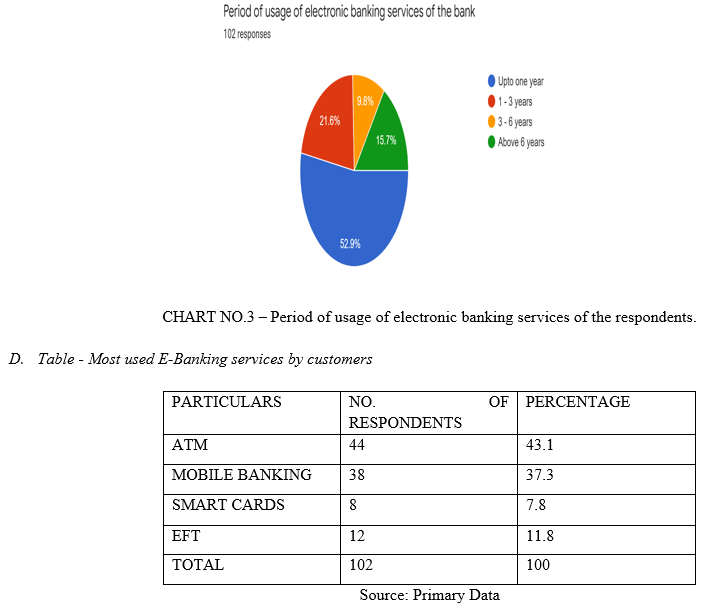

C. Table - Period of usage of electronic banking services of the respondents.

|

PARTICULARS |

NO. OF RESPONDENTS |

PERCENTAGE |

|

UPTO 1 YEAR |

54 |

52.9 |

|

1 – 3 YEARS |

22 |

21.6 |

|

3 – 6 YEARS |

10 |

9.8 |

|

ABOVE 6 YEARS |

16 |

15.7 |

|

TOTAL |

102 |

100 |

Source: Primary data

- Interpretation: From the above table shows that period of usage of electronic banking services of the respondents upto 1 year are of 52.9%, 1-3 years are of 21.6%, 3-6 years are of 9.8% and above 6 years are of 15.7%.

- Inference: Period of usage of electronic banking services of the respondents upto 1 year are with 52.9%.

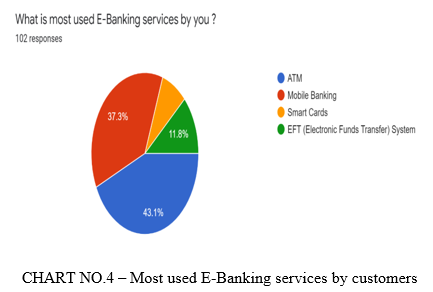

- Interpretation: From the above table shows that most used e-banking services by customers are ATM are of 43.1%, mobile banking are of 37.3%, smart cards are of 7.8% and EFT are of 11.8%.

- Inference: Majority of the respondents use ATM with 43.1%.

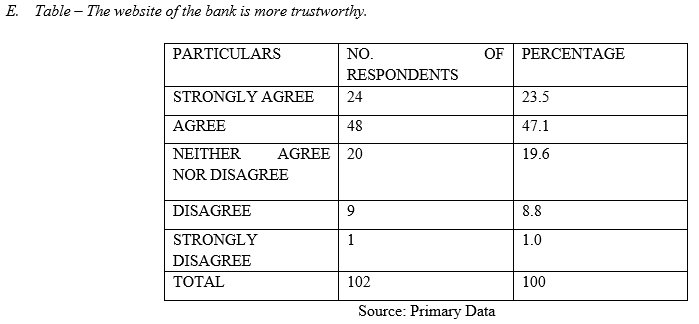

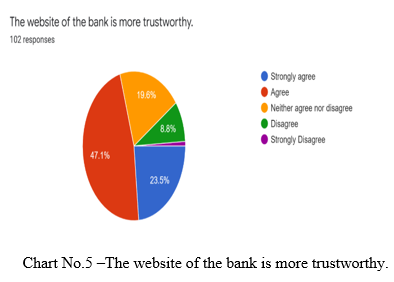

- Interpretation: From the above table shows that the website of the bank is more trustworthy of respondents strongly agree are of 23.5%, agree are of 47.1%, neither agree nor disagree are of 19.6%, disagree are of 8.8% and strongly disagree are of 1%.

- Inference: Most of the respondents agree for the website of the bank is more trustworthy are with 47.1%.

V. FINDINGS

- 53.9% of the respondents are from the age 21-30 years.

- 59.8%. of the respondents are of gender belongs to male.

- 56.9% of the respondents are of public sector bank.

- 52.9% of the respondents Period of usage of electronic banking services up to 1 year.

- 43.1% of the respondents use ATM.

- 45.1% of the respondents strongly agree for Electronic Banking provides greater flexibility and faster than traditional banking services.

- 35.3% of the respondents agree for Electronic banking transactions are accurate and error-free.

- 47.1% of the respondents agree for the website of the bank is more trustworthy.

- 42.2% of the respondents agree for Electronic Banking protects the customers personal and financial information and not shared with other websites.

- 55.9% of the respondents agree for The responses of Electronic banking are accurate, appropriate and relevant.

VI. SUGGESTIONS

Current efforts are aimed at analyzing customer perception towards e-banking services of public and private sector banks. This is an analytical search of that would be a useful contribution. However, to achieve any generalization, we are eager to perform more analytical studies of this kind. The scope of the study was limited to customer usage behavior for selected public and private sector banks in the Hyderabad region. Similar study can also be conducted in other parts of India for comparison. A comparative study can also be done on the services of Indian and foreign banks in the same or other regions of India.

Conclusion

Now days, E-banking services have become a major weapon for survival of banking industries. The major theme of the research was to study the customer perception on E-banking services towards public and private sector banks in the Hyderabad region. Customer delight and customer support shipping are key detail for banks to envision purchaser acquisition, retention and growth financial institution profitability. New technology enabled banks to serve and help customers now no longer best in branches. With the benefit of virtual channels, customers are travelling branches much less regularly and that they use e- banking for his or her banking desires greater regularly. From the research it is concluded that electronic banking culture is spreading rapidly among the customers. The factors like physical aspects, reliability, security and privacy, efficiency will influence the customer perception towards electronic banking services. There is a positive opinion on electronic banking system and their services by public and private sector banks and to promote this among the others.

References

[1] Abid, S. (2016). Electronic Payment System - An Evolution in Indian Banking System. IOSR Journal of Economics and Finance , 7 (2), 25-30. [2] Dhar K Ravi. (2009). Service quality expectations and perceptions of public and private sector banks in India- A Comparative Study. Indore Management Journal, 19(3), 34- 39. [3] Fozia, M. (2013). A comparative study of customers\' perception towards E-banking services provided by selected private & public sector bank in India. International Journal of Scientific and Research Publications, 3(9), 1-5. [4] Jalil, M. A., Talukder, M., & Rahman, M. K. (2014). Factors Affecting Customer\'s Perception towards online Banking transactions in Malaysia. Journal of Business and Management , 20 (1), 25-44. [5] Khan, B. U., Olanrewaju, R. F., Baba, A. M., Langoo, A. A., & Assad, S. (2017). A Compendious study of Online Payment system: Past Development, Present Impact and Future Consideration. International Journal of Advance of Computer Science and Applications , 8 (5), 256-271. [6] Madavan, K., & Vethirajan, C. (2020). Customer Satisfaction on E-Banking Services of Public and Private Sector Banks in Puducherry Region-An Empirical Analysis. International Journal of Management (IJM), 11(6). [7] Mathivanan, D. B., & Kavitha, S. (2015). A Study on Consumers perception towards e-banking services of ICICI Bank. International Journal of Innovative Research and Development , 4 (12), 26-33. [8] Qureshi, T. M., Zafar, M.K., and Khan, M.B. (2008), “ Customer Acceptance of Online Banking in Developing Economies “, Journal of Internet Banking and Commerce, Vol. 13, Iss.1, pp. 2-9. [9] Rajput, D. U. (2015). Customer Perception on E-Banking Service. Pacific Business Review International , 8 (4), 1-3. [10] Sawant, K.B. (2016). A comparative study of factors affecting service quality and level of customer satisfaction in Local and Foreign banks in Oman. [11] Singhal, D., & Padhmanabhan, V. (2008). A study on Consumer Perception towards Internet Banking: Identifying the Major Contributing Factors. The Journal of Nepalese Business Studies , V (I), 101-111. [12] Sumathy, D. M., & KP, V. (2017). Digital Payment System: Perception and Concern among Urban Consumers. International Journal of Applied Research , 3 (6), 1118-1122. [13] Vij, J., Vij, K., & Vij, V. (2014). Role of E-Banking in Current Scenario. International Journal of Technical Research and Application , 64-68. Mathivanan, D. B., & Kavitha, S. (2015). A Study on Consumers perception towards e-banking services of ICICI Bank. International Journal of Innovative Research and Development , 4 (12), 26-33. [14] Yogeswaran G. (2015). Customer perception towards services provided by public sector and private sector banks- A Comparative study. Global Journal of Commerce and Management Perspective, 4(1), 68-74.

Copyright

Copyright © 2022 Papunuka Lakshmi, Dr. Thamilselvan. R. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET42627

Publish Date : 2022-05-13

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online