Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

FinTech

Authors: Mayuri M. Gawade, Sachin S. Sawant, Sankalp Savane, Savvy S Gaikwad, Kedar Sathe, Srusthi Satte, Aarya Sawane

DOI Link: https://doi.org/10.22214/ijraset.2023.52566

Certificate: View Certificate

Abstract

Fintech is one of the fastest growing domain. With the shift of world to digital platforms due to covid, digital transactions have gained lot of importance and attention. Big scale transaction like for buys cars to smaller once like at vegetable vendors, online order placing and food, reservation or bills, everything can be done online with much ease than carrying large amount of cash or card everywhere. This wide use of digital platform calls for being aware of fintech in every aspect. Here in this paper have introduced fintech, its branches and various other topics in such a way that it becomes a lot easier and more interesting to read.

Introduction

I. INTRODUCTION

Fintech is abbreviation used for term Financial Technology. It is using technology for the financial operations like digital payment, depositing check, investments and online trading and related services. It is merging of technology and financial services. It was primarily referred to back office works in which computers were including for keep record and much more. The stream was emerged in 21st century itself. It made changes in the traditional way of banking and made it super simplified. There are various sectors in the domain which will be explained in latter part of the paper. The main initiative of this is to do broad range of traditional banking actives without much need of human employes and keeping record easier enabling transactions being more efficient and hassle free. To talk statically, the size of fintech market in increased steadily from 2014 to 2017 which had $19.9bn to $39.4bn at a CAGR of 18.5%. This picture got broader in 2018 when $41.7bn was invested in 789 deals. $111,240.5 million in 2019. The pandemic has brought even more attention to the digital payment sector. 78 billion in 2020 and is projected to grow at a CAGR of 26.87%. Fintech surpassed $110.57 billion in 2021. It is predicted that by 2030, it will reach $698.48.

The scenario in India is quite broad. The companies have gotten more than $30 Bn fund since 2014, $29 bn in funding across 2,084 deals till July 2022. This has set record of gaining 14% share of the global funding and ranked 2nd on the deal volume. Also, we have the highest adoption rate which is 87% and 3rd largest FinTech ecosystem. Currently there are 2,000+ DPIIT (Dept. for Promotion of Industry and Internal Trade) recognized FinTech startups. The market size was $50 Bn in 2021 and is estimated at ~$150 Bn by the year 2025. Till September 2022, UPI (Unified Payments Interface) has gotten participation of 358 banks, 6.8 Bn transactions more than $135 Bn of worth.

II. BENEFITS

Here are some of the benefits of using or expansion of Fintech:

A. Currency is Turning Digital

We all have realized how the shift in mode of payment have occurred in last few years. The transactions have been majorly digitally available. India is 2nd largest phone owner, so this is convenient to large section of public. It also makes up a huge reason why startup and many funding are into this section of fintech.

B. Faster and Easier

Account formation takes less time and submitting applications and documents. Many people who were ready to open bank account or make transaction but couldn’t because of time or because they found it difficult got their work done in faster and easier way through fintech.

C. Flexible is the Key

Fintech provides various options of customizations, information and automation according to demand of users and bank. This makes it efficient and easy to use, which makes up another reason this sector is blooming and attracting users as well as investors.

D. Powered by AI

The use of AI in the sector has led to significant rise of benefits of the domain by increasing the productivity and decreasing the time needed for it. In 2021, AI in the fintech market was valued at $8 billion. Data entries, customer care, processing of loans and transection, advisors, security are some of its major roles.

E. Links with Banks

Banks are using fintech for reaching to customers faster, better and in more organized manner. The public is getting easy access to policies, funds, available benefits, customer care and application forms. This also makes publicity easily. And all this within lesser time, efficiently and without need of much human resource

F. The Social Betterment

This help people at locations where banks aren’t established or couldn’t be established around the world. This also solves of problem like devices of banks not working, staff not available at that time, long queues and can deal with many customers at once.

Many a time some low income or customers who are seen as incapable aren’t given enough time, attention or information about the policies and schemes. This helps these section of public in various ways.

This can eliminate the black money circulation by making non fiat mode transactions.

The companies of app also help government with collection of taxes.

These are just some reasons why the companies who are socially conscious make investments.

III. DOMAINS

The are many areas of fintech. In these the major sectors are as follows and some examples will be given in further section:

A. Insurtech

This sector help with Insurance related works. It takes help from well-developed sectors like AI, ML, software development, block chain and even drones to introspect the property. It gives various benefits like enabling broker or agent to get best suited policy for the clients and cutting down the waiting time.

B. Regtech

This sector deals with laws by monitoring them and reporting in case of complications. Also it offers feature like trade monitoring and tax management. This plays huge role in knowing of rules and making sure they aren’t ignored by anyone, neither user nor firms. This makes fintech more trustable and reliable.

C. Digital Payment

Online payment has been largest among these in terms of use as well as investment. It makes payment easy on multiple level just by having access of internet, smart phone and online payment options enabled on bank account. It has card issuing, mobile payment, merchant acquiring and many more. This sector is widely used by all kind of section of people, shopkeepers, rickshaw drivers, vegetable sellers, restaurants and customers.

D. Cross Border Payments

These deals with digital payment but on an international scale. It was recently affected and had decline due to covid 19 but it will soon get back on normal trend. This allows investors to invest in foreign companies, send money to family and friends, have access to foreign goods and many such benefits. This also played important role in blooming use of cryptocurrency.

E. Roboadvisor

This provides users with proper plan for investment, savings and budgeting based on the algorithms and boast financial stability. It lowers the cost of output, cuts off time needed and increases accessibility to every individual with high rate of accuracy to provide best possible plan for the user.

F. Digital Share Broker

Since digital share are becoming more liquid, more to the public light and gaining fair attention so is the need of digital share broker increasing. The situations calls for platforms which would help us understand the very basic of stock trading and the trends with no risks at all.

G. Cryptocurrency

These are basically digital tokens, some of the best known in this category are bitcoin, Ethereum. They are built using block chain technology and AI, ML and such technologies inculcated in them for better performance. It majorly allows user for transactions and investments of these tokens.

H. Fraud Analysis Software

This deals with one of the most important side of fintech which is security. This uses AL and Ml with various algorithms to detect alerts and risks. This is one of the aspects of most of the investors and users which is ensured by them for safety and security of data and money.

I. Lending Solutions

Loans and investments have been one of most important part of finance. This connects entrepreneur to its potential investors and has neo banking options. This also has very high chances of getting the loan approved and that too in lesser time, lower cost and lower interest rate. This is highly beneficial for startups and small business which also further have social impact on boasting innovation. Covid 19 brought focus on this sector majorly for people seeking lesser and easier loans.

IV. COMPANIES

A. Over All View

The companies make fintech facilities available to people by digitalizing the finance. These companies earn money based on their functions. Like apps collect revenue by some amount of fees, adding up loan interest, brokage fees, finance products, extra charges on each withdrawal. Based on data of November 2021, there were 10,755 startups in America, 9,323 in Europe, Middle East and Africa regions and 6,268 in Asian Pacific parts. Consumer adaptation rate has grown rapidly, as in 2019 75% of consumers have been shifted to digital payment methods. The sector of Insurtech has gone from 8% in 2015 to 50% in 2019.

B. In India

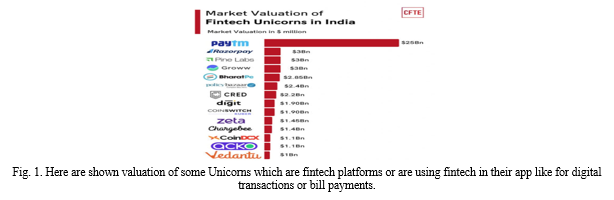

As mentioned in the introduction of the paper, India has been ahead in growth of fintech and brought many positive results as well as changes. The adoption rate is increasing rapidly and the fintech startups have tripled in last 2 years which further contribute to rise in investments of the sector with rise up to $226.7 bn in 2021. Fintech has captured about 26% of over-all investment as of 2021 July. 23 companies have gained ‘Unicorn Statute’ which have valuation of nearly $1bn. The investments keep increasing until 2020. Then 2021 recovered with 474 deals and first half of 2022 boasting numbers by reaching till 224. The adaption of fintech was faster as we are country with second largest internet base. Payment sector is the largest used with having nearly of 20% of the companies in fintech and 53% share of funds in fintech in 2021.

C. Examples of Companies and their Workings

- Paytm: It is biggest fintech company in India being valued over $12 billion in first half of year 2022. One97 communications is its parent company and has many unicorns around the world ($338 billion worth deals) including this one. It is an UPI (Unified Payment Interface) based application and has been part of 150 million transactions in February 2021. The Paytm Payments Banks were licensed in 2015 and services have online payment services and not credit cards or loans. There is no spending limit, the users can keep up to Rs. 10,00,000 in Paytm Wallets.

- BHIM UPI: In 2022, this app was 50% of other payment sectors. This was developed by NPCI (National Payment Corporation of India) and is non-profit company and is under Reserve Bank of India. This app got 1 crores downloads from android store and over 2 million transactions across the Unified Payment Interface (UPI) and Unstructured Supplementary Service Data (USSD) platforms. The limit of single transaction is Rs. 10,000 and in a day, Rs. 20,000. USSD has limit of Rs. 5000 a day. “The main purpose of BHIM App is to provide uniform experience of UPI and also to support those banks who have not developed any UPI app for their customers as yet”, says NPCI MD & CEO.

- Coinswitch: This India app is a Crypto startup with total funding of over $300.6 million. It has 14 technology products and services in which the transactions are done in form of cryptocurrency only. This also has a referral program. This app is known to reduce the risk of trading in cryptocurrencies and also are appreciated by their customer services. The fees apllied can be between 0% to 0.49% of the total trade depending on the terms.

- Razorpay: Another Indian startup which has gotten to great achievements with total fundings of $816.3 million. Unlike others, it gives control on EMI, credit card, mobile wallets, net banking, debit card and UPI. It supports domestic as well as international transitions. The payment link is one of the best feature which saves time as well as efforts in cases where many payments are to be done to a single person.

- PhonePe: More than 7000 transactions out of which Telangana, Maharashtra and Karnataka are on top most transactions and had 46% of share in UPI payments. It has linked wallets like to Jio Money, Freecharge, Ola cabs, Delhi Metro, Red Bus and many more. Its feature of scanning QR and paying to merchant feature has helped resolve many problems of small vendors. Rs. 1 lakh can be transferred here in 3 seconds and hence is also preferred for tasks like funding, fee payments, loans and big payments. It also has feature of autopay of bills and discounts are given on transactions done on the app.

- Google Pay: Had 34% of share in UPI payments and is 2nd most popular payment platform in India. It’s also has a feature of making group payments and split bills, earn discounts and find offers. It also let buy things online also in the app. One of the smartest move of the app is that it gives user a unique encrypted number instead of the actual credit card number while transaction, this keeps data safe for user, Google Pay Send feature allows to send money just by entering mobile number or email address.

- Perfios: This is an Indian data analytical platform which received over $120 million worth fundings. It is mostly used by non-bank financial companies (NBFCs). Due to its powerful data analytics on financial data, preventing fraud, managing asset, generating bank statements and digital credit reports, it has many big clients like Canara HSBC, Deutsche Bank, Yes Bank, Axis Bank and many more.

- Wealthfront: It is one of the further most robo advisor with $25 billion assets under management (AUM) and 4,40,000 users. The fees of 0.25% of accounts but has no charges on transaction. It has multiple options and 17 global asset classes. It has many investment options like for after retirement, for college students, for startups and many more like these and it can also be done in cryptocurrencies. It was recently acquired by the company UBS and is expected to boom at a higher rate now.

- Kasisto: Using AI and advanced NLP (Natural Language Processing), this platform generates answers to queries of user and is a digital assistant. It is used for consumer banking, investment management, business banking and many more applications. It has netted $66 million in venture capital. This platform has many high-profile customers like Emirates NBD, Westpac and J.P. Morgan.

- Adyen: This has everything in it. It supports digital payment, issues cards, works as point of sale app, risk management, perform analytics, revenue optimization and more. The availability of all features on one platform makes it convenient for customers. It has presence around the world with their offices at more than 26 places globally with one of them situated in Mumbai but is originally a Dutch company. Due to its diverse functions, it has many big clients like McDonald, Linkedin, booking.com, Uber and more.

- Suplari: It is an expense management and cost saving platform which helps big corporation with finance management. It saves up a lot of time needed to analyze and data entries at multiple places with improving forecast accuracy. This platform is used by many top tier companies like Hulu, 21st Century Fox and Nordstrom. In 2021, the platform was under taken by Microsoft.

- LendingClub: It is a peer-to-peer loan leading platform in which small business owner, startups and individuals gets loans from multiple individual collectively. It is way more hassle free and easier than getting loans at banks in the traditional way. More than 4 million users till date have used this platform to invest or for banking or for borrowing. It allows maximum efficiency in minimum steps.

- Featurespace : This plays important role in security and is a risk detection software solution. It has more than 500 million users, 50.4 billon process each year and 75% of fraud attack block rate with 5:1 false positive ratio. And due to its strong protection measures and analysis, it has customers like TSYS Foresight Score, Wordplay, HSBC and many more.

V. LAWS IN INDIA

Financial sector is one of the most heavily regulated sector and has multiple regulations and laws to be kept in mind. The emergence of fintech which was a new type of finance called of more strictness, consumer protection and awareness needed. Hacking of account and devices, misuse of the personal information, transactions without permission and many more issues arise due to digitalization of data. At many times, the made rules and regulations aren’t regulated and create space for cyper crimes related to fintech and misuse of data. Due to scams and frauds, people are afraid to use fintech with its whole potential. Because of diversity in sector fintech, it is difficult to make uniform rules in every section and applying to all. Many times, the government has just reworked the existing rules. As much as its needed, it is also a backlash because it creates irregularity on an international level. The dealings of cross boarder payment and cryptocurrencies are restricted to multiple rules varying from country to country. Thus there should be a right balance in promoting technology for betterment of the users and setting up them to limits to protect users. The regulations related to goods and services are majorly governed by the Reserve Bank of India (RBI), Securities Exchange Board of India (SEBI), Ministry of Corporate Affairs and Ministry of Electronics and Information Technology (MEITY), Insurance Regulatory and Development Authority of India (IRDAI).

Following are some laws and regulations that should be followed by fintech sector:

- The Payment and Settlement Systems Act, 2007 – PSS Act

It deals with payment systems in India, A “payment system” is defined by the act as “a system that permits payment to be made from one person to another”. It includes money transactions, smart card operating, debit and credit card operating but excludes the stock exchanges. It mentions that a payment system cannot be created and operated without Reserve Bank of India (RBI’s) permission.

2. The Companies Act, 2013

This demands that all fintech businesses should be under the Act and must follow all of the laws and regulations just like every business in the Country. All the working companies should be authorized and incorporated under the Act.

3. The Consumer Protection Act, 2019

According to Section 2(47)(ix) of the Act, “disclosure of consumer’s personal information supplied in confidence, unless required by law or in the public interest,” is considered as an unfair trade practice. This includes details like back account number, password, transactions done, amount balance in an account and many more if we take of data in fintech.

4. The Information Technology Rules, 2011 –

The law is similar to the one mentioned above, it prohibits the disclosure of a user’s details without the permission of user’s authorization unless required by the law. In accordance with Section 43A, businesses are held responsible for the damages done in case they couldn’t take necessary security measures to protect the personal details of the users. This also contains the Information Technology Act of 2000 (IT Act) and is held to be one of the most important laws not only in fintech but in any kind of digitalized sector.

5. The Prevention of Money Laundering Act, 2002 - PMLA

The main regulations which forms anti-money laundering standards. It comes with similar laws which are the Prevention of Money Laundering Rules 2005, and the KYC Master Directions. It applies to banking firms and financial institutions including the once that are digital (like neo banks) demands to confirm the identity and save their record and further sent the information to the Financial Intelligence Unit – India (FIU – IND).

6. The Reserve Bank of India Act, 1934

This are applied to all the existing NBFCs (Non-Banking Financial Companies) in India. They must have issuance of NFBC license for which the company must fulfil a number of standards and then receive it from RBI. According to the governor of RBI, a surveillance technology known as SupTech for data analysis and collection.

7. The Insurance Act, 1938

The Insurance Regulatory Development Authority of India (IRDA) regulates laws related to the insurance sector, the companies should get grant from this. Either they receive direct insurance broker license to be able to legally sale the insurance product or some get corporate agent license which is being a representative of trust or cooperation.

8. The Foreign Exchange Management Act, 1999 - FEMA

These are RBI’s regulations which deal with cross border payments and foreign currency. Only Accredited Dealer Category II Entities have the permission to give out prepaid foreign currency card in India to Indian citizens. The PPI (Prepaid Payment Instruments) Master Directions allows PPIs to be issued only by a qualified body for all the international transactions.

VI. SCHEMES AND PROGRAMS BY GOVERNMENT

The Indian government has taken many steps to make fintech available to general public and to create awareness about it. It has several political (like demonetization done in 2016) as well as economical or social (like when Covid hit the country and being digital was the best option) reasons for these steps. These programs are organized for everyone and every section of society without reviewing criteria like minimum income, credit score or age which are generally seen by banks before offering their services which is mandatory. It has special programs of every domain services and financial help, awareness and management. Many sections of society are fairly aware of what fintech has to offer and ways to use it without encountering frauds, scams or loss whereas at other hand, there is huge percentage of people who don’t even have any idea of existence of fintech and digitalized platforms.

The initiative is to make the wall between these two sections thinner and creating more awareness. These are some of the steps taken by government:

- The Digital India Program

This was a flagship program taken by the government to create strong empowered society. This was done under the National Payments Corporation of India (NPCI) under Reserve Bank of India and the Indian Banks’ Association creating feasible infrastructure for payment system. It has 3 pillars:

a. Digital Infrastructure available to every citizen - High internet, digital identity, safety and security

b. Governance and Services on demand – Integrated services, digital platformed business, cashless transactions

c. Digital Improvement – Digital Literacy, Access to resources (in different languages), Online submissions of documents

2. Jan Dhan Yojana

This is world’s largest fintech inclusion initiative and have helped in making of over 450 million bank accounts for poor and needy section of society to give various important financial services like insurance, credit, pension, saving, remittance, deposits and many more. The features it gives is that no minimum balance (in case the cheque facility isn’t required), interest rate is given as per the savings in the account and overdraft is available.

3. Atal Pension Yojana

The is for the poor and low income individuals (with age between 18 to 40) who are working in unorganized sector to have a steady pension after retirement. This was announced by the government of India in 2015 – 2016 budget. It has pension of Rs. 5000 each month and tax benefits are provided with it. The Indian government co-contributes to the scheme. It is a risk free scheme.

4. Stand up India Loan Scheme

This scheme is for the women or SC/ST entrepreneurs who struggle to gain investments and loans for their startups. This enables at least one SC/ST and one woman client from every bank branch to get loans from Rs. 10 lakh up to Rs. 1 crore to set up their business which may involve manufacturing, services or trading. In case of group enterprise, a minimum of 51% of shareholding and controlling must be held by someone who is a women candidate or must belong to SC/ST.

5. E-RUPI

National Payments Corporation of India (NPCI) with Department of Financial Services (DFS), National Health Authority (NHA), Ministry of Health and Family Welfare (MoHFW) and partner banks has launched this. It is an innovative digital solution which is a one time payment system and can redeem the voucher without a card, internet banking access or a digital payment app and such platforms at the merchant accepting e-RUPI via SMS or QR code. It was also involved in cashless payment options for Covid vaccinations

6. India Stack

It is set of open APIs (Application Programming Interface) that gives business, startups or developers a digital infrastructure and unlock economic primitives at large scale. It played huge catalytic rule in evolution and use of fintech and is one of the most important digital initiatives globally with 6 billion digital verification and 5.47 trillion INR of total mobile payments with the volume of 2.8 billion.

7. Financial Literacy

The government has been taking steps to make the country highly financially literate. One of them is setting up National Centre for Financial Education (NCFE) and implying the Centre for Financial Literacy initiated by the Reserve Bank of India (RBI). Their main objective is to increase financial literacy of all sections of population.

8. DigiShala

DigiShala is educational channel for awareness and use of digital payment on the free dish Door Darshan which reaches around 2.5 crore houses in generally in rural area and people from low income section. It comes in multiple reginal language and gives information about tools and related information about its services to it. It also presents step by step process using UPI, Aadhaar and many more. It also hosts interviews and discussion with experts in the field. This makes public in semi urban and rural area aware of digital platforms and encourages the use of it.

9. UPI

Unified Payments Interface (UPI) developed by the National Payments Corporation of India (NPCI). It merges multiple banks (382 as of December 2022) into single platform for using several banking features and uses. Different bank accounts can be accessed using one single application. It has simplified payment within accounts of different banks and help different apps to make it easier. The function of AutoPay in which recurring payments such as phone bills, electricity bills can be done by using UPI.

VII. OUR SURVEY

We did a small scale survey out of 100 people using google form.

In that the main focus was on how many people are aware and are using the 3 most widely known domains, digital payment, online trading and cryptocurrency. We also tried to see how many didn’t had knowledge about it and the laws of fintech and fintech itself. We also tried to see up to how different age groups have different responses.

We asked the participation the following questions and summary of them:

Their age group?

15 – 20 83%

20 – 25 7%

25 – 30 2%

30 – 45 5%

45 – 50 3%

Do they know about fintech?

Yes 62%

No 38%

Which mode of payment did they preferred?

Digital Payment 75%

Cash 25%

How did they got to know about digital banking?

Friends and Family 59%

Publicity by apps 16%

From Work 3%

At Stores 9%

News Sources 6%

Programs of Digital Awareness 5%

Others 2%

Which platform do they prefer for digital transaction?

Google Pay 52%

Paytm 15%

PhonePe 19%

Fampay 2%

YONO 1%

Amazon Pay 1%

BHIM 1%

UPI 1%

None 10%

Do they think digital transaction is safe?

Yes 82%

No 17%

Have they faced any scams while performing digital transaction?

Yes 10%

Someone I know did 30%

No 60%

Do they invest in crypto currencies, if yes which one do they think is the best?

Yes 11% – Bitcoin 2

Solana 1

XPR 1

Polygon 1

BNB 1

Dogecoin 2

Ether 2

Litecoin 1

No 74%

No knowledge of it 12%

Do they have interest in online trading?

Yes 45%

No 31%

No knowledge about it 24%

Do they know about laws related to above mentioned topics?

Yes 36%

No 64%

Conclusion

A. Of the Survey From the survey we can see that the digital payment sector is highly accepted by people whereas the crypto currency as well as online trading sector are still lagging and need more publicity and awareness. We have seen the numbers of participants preferring different platforms for payment and also as mentioned in the above companies section, there are many companies giving various range of features. There are still people doubting the security of the digital platforms as some of them have come across the situations of scams and frauds. As we can see from above, most of the participants have got to know about these platforms from friends and families, by publicity of apps or directly at stores when they are implemented to use. And from survey, we also realized that middle aged participants generally preferred digitalization only up to an extend, like using digital payment platforms but not trusting it, not having knowledge about cryptocurrencies or about online trading. Another thing that was brought to the light was that a huge amount of participants who user digital transaction platforms and also other domains, didn’t had any knowledge about the laws and regulations related to fintech. B. Of the Paper The fintech sector has many plus points over the traditional financial style on and individual as well as on a society level. It has multiple domains and each domain has its own function and benefit for the society. It is surely booming at a high pace but it might still need some proper ways of reaching out to public so that all the domains are covered to all the section of people. We have also mentioned above the steps that are taken by the government to make features of fintech available to everyone, still it need a bit of push. Some sectors are highly appreciated and some stayed unknown which may lead to people not utilizing the available resources of fintech to it fullest. The security measures should be strengthened so the people will use multiple platforms without and risks and worries. Laws and schemes available in our country should be reached to everyone. The startups and the entrepreneurs should receive more spotlight and appreciation. And some small steps like this will make our country digitally stabilized in case of finance.

References

[1] Bo Li and Zeshui Xu [2021]. Insights into financial technology (FinTech): a bibliometric and visual study. Financial Innovation volume 7, Article number: 69, SpringerOpen. URL: https://jfin-swufe.springeropen.com/articles/10.1186/s40854-021-00285-7 [2] Anil Kavuri (Loughborough University) and Alistair Milne (Loughborough University) [2019]. Fintech and the Future of Financial Services: What Are the Research Gaps? SSRN Electronic Journal URL : https://www.researchgate.net/publication/331244922_Fintech_and_the_Future_of_Financial_Services_What_Are_the_Research_Gaps.3 DOI:10.2139/ssrn.3333515 [3] Philip Booth and David Currie [2023]. The Regulation of Financial Markets, SSRN Electronic Journal. URL : https://www.researchgate.net/publication/368368354_The_Regulation_of_Financial_Markets DOI:10.2139/ssrn.4350617 [4] Mats Lewan [2018]. The role of trust in emerging technologies, in book: The Rise and Development of FinTech (pp.111-129) chapter: 6. Publisher: Routledge, Stockholm School of Economics URL : https://www.researchgate.net/publication/330898061_The_role_of_trust_in_emerging_technologies_chapter_6_in_\'The_Rise_and_Development_of_Fintech\' DOI:10.4324/9781351183628-7 [5] C. Vijai [2019] Fintech in India – Opportunities and Challenges SAARJ Journal on Banking & Insurance Research (SJBIR) Vol 8, Issue 1. St.Peter’s Institute of Higher Education and Research URL : https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3354094

Copyright

Copyright © 2023 Mayuri M. Gawade, Sachin S. Sawant, Sankalp Savane, Savvy S Gaikwad, Kedar Sathe, Srusthi Satte, Aarya Sawane. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET52566

Publish Date : 2023-05-19

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online