Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Impact of Financial Inclusion on Women Empowerment: A Case Study of Ranchi District

Authors: Dr. Amar Kumar Chaudhary, Rinki Kumari

DOI Link: https://doi.org/10.22214/ijraset.2022.46423

Certificate: View Certificate

Abstract

Women play a crucial part in shaping not just the home but also the society as a whole and her influence in its evolution is undeniable. In today’s world, the participation of both men and women is the sine qua non to have sustainable economic development. This paper’s main goal is to examine the current state of women’s engagement in banking and financial operations. The study also discusses how financial inclusion leads to women’s empowerment in society. 150 rural women from Ranchi District were recruited for the study, and 13 questionnaires were created to assess their knowledge of various financial schemes, subsidies, and services offered by the Government of India. SPSS software was used to check the accuracy and significance of the study. The study’s findings show that women have a high level of interest in financial and banking services, financial inclusion has low but positive impact on women empowerment and there is a long way to go, illiteracy, reliance, and lack of awareness among women remain barriers to empower them.

Introduction

I. INTRODUCTION

Women account for roughly half of the country's overall human population. As a result, women's contributions to the country's progress and prosperity are just as essential as men's, but women continue to experience discrimination based on health, literacy, finance, birth, employment rights, and pay. Prior to the arrival of the British, Indian women were active in small businesses, but with the arrival of the British, greater emphasis was placed on the manufacture of Indigo, with smart men being more involved in the process than women.

As a result of the lack of social and economic advancement for women, they eventually became a burden to the household as they were homemakers. In India, women’s empowerment has been a major concern over the past decade. Women’s empowerment is the process of creating an environment where women can take their own decision. A woman’s financial stability and financial literacy are two significant factors that influence her decision.

Empowerment is a complex concept it is integrated into many ways. It derives from the term "empower' which means to give power or authority and enable or permit. Empowering can be defined as providing authority in order for the poor and vulnerable members of the society, particularly women, to have the ability to make their own decision. United Nations' new women's flagship reports Titled Turning Promises into Action: Gender Equality in the 2030 Agenda for Sustainable Development said that Sustainable Development Goals would be difficult to achieve without gender equality and women’s empowerment. In fact without equal involvement and contribution from women, growth in any field would be inadequate .According to research women in India are still largely financially excluded in comparison to men despite many Government approaches through programs and schemes to improve access to financial inclusion in India.

The Government of India and RBI have introduced a policy of "Financial Inclusion". Financial Inclusion's main objective is to provide financial services at an affordable cost to each and every segment of the society, especially vulnerable and deprived sections. Many programs and schemes have been started by the Government of India for financial inclusion including, the Pradhan Mantri Jan Dhan Yojna (PMJDY) and Rashtriya Mahila Kosh. Women who opened bank accounts under the Pradhan Mantri Jan Dhan Yojna (PMJDY) have also benefited from numerous other schemes related to enterprenureships, insurance, and pension schemes like Pradhan Mantri Jeevan Jyoti Bima Yojana (PJJBY), Pradhan Mantri Suraksha Bima Yojana (PMSBY ), Atal Pension Yojana (APY), and Start Up India .

Table 1 -Financial Inclusion Schemes by Government Of India

|

Scheme |

Details and Benefits |

Eligibility |

|

Pradhan Mantri Jan Dhan Yojana (PMJDY ) launched in 2014 |

|

|

|

Pradhan Mantri Jivan Jyoti Bima Yojana (PMJBY) launched in 2015 |

|

|

|

Pradhan Mantri Sukarsha Bima Yojana (PMSBY) launched in 2015 |

|

|

|

Atal Pension Yojana (APY) launched in 2015 |

|

|

|

Start Up India (SUI) launched in 2016 |

|

|

Source: Financialservices.gov.in

A. Women Empowerment

“There is no tool for development more effective than the empowerment of women "Stated by UN General Secretary Mr. Kofi Annan.

Empowerment can overall be defined as all those processes where women can take control and ownership of their lives. Women empowerment is a process of enabling women to have access to and make a productive contribution to their economic independence, political participation, and social development. Empowerment is an ongoing process and not an end by itself. The process involved in empowering are: Growth in people's awareness and confidence, ability to articulate problems, gaining access to resources and public facilities, and negotiating over relations between different social groups ( reddy , 2002).Empowerment enables individuals to realise their identity and powers in all aspects of life. It consists of greater access to knowledge, education, skills, and resources, greater autonomy in decision making, and freedom from the shackles imposed on them by custom, beliefs, and practices in society. . Due to their financial dependency on males, patriarchal Indian society has long denied women of their powers and potential. As a result, the Government of India has taken a number of steps and created a number of initiatives to increase women's financial inclusion. Gender inequality continues to be a major impediment to women's financial independence. Financial inclusion for women can contribute to socioeconomic and political empowerment.

B. Financial Inclusion

Financial exclusion refers to the situation where individuals and populations do not have access to basic financial services. Financial Inclusion includes loans, credit, cashless transactions, savings accounts, and traditional banking services. People are often excluded due to socioeconomic situation, poor-income status, or inability to satisfy banking service requirements. To overcome the situation Dr.Y.Venugopal Reddy, the then-Governor of the Reserve Bank of India, first introduced financial inclusion in India in the Annual Policy Statement in April 2005. The main objective was to transform them from financially excluded to financially included.

The Government of India’s Committee on Financial Inclusion in India defines “Financial services and timely adequate credit where needed by vulnerable groups such as the weaker sections and low income groups at an affordable cost “ (Rangarajan Committee,2008) .

Inclusion as the process of ensuring access to financial services and timely adequate access to Financial Inclusion, broadly defined, refers to universal access to a wide range of financial services at a reasonable cost. These include not only banking products but also other financial services such as insurance and equity products ( The committee on Financial Sector Reforms, Chairman : Dr, Raghuram G. Rajan ). The Reserve Bank of India ( RBI) , in 2015 , refers financial inclusion as " the process of ensuring access to appropriate financial products and services needed by vulnerable groups such as weaker sections and low-income groups at an affordable cost in a fair and transparent manner by mainstream institutional players .’

Hence financial inclusion can be defined as a process to make financial products and services accessible to every individual especially low income and weaker sections of the society who lack access to even the most basic banking services at a reasonable cost. Its main aim is to bridge the gap between the rich and poor people for achieving economic growth in the country.

C. Financial Inclusion and Women Empowerment:

Poverty alleviation and economic growth are both aided by financial inclusion. Access to basic financial services assists the poor and vulnerable, particularly women, in breaking free from the vicious cycle of poverty and empowering themselves and their family. In India, financial inclusion is regarded as one of the most important factors in attaining overall inclusive economic growth and community development. "There is mounting evidence that financial inclusion has a multiplier effect on total economic production, poverty reduction, and income inequality reduction at the national level." Women's financial inclusion is critical for gender equality and economic development, according to the RBI's National Strategy for Financial Inclusion (NFSI).`Empowerment is defined as a multi-dimensional social process that enables people to gain control over their own lives. It is a process that fosters power in people, for use in their lives, their communities, and in their society, by acting on issues that they define as important ‘. (Page, 1999)[1]

Kabeer (1999)[2] has defined women empowerment as “the ability to make strategic life choices in a context where this ability was previously denied to them ‘. There are varied reasons for low financial inclusion and literacy among women. A majority of the women in India, especially in rural areas, are homemakers, which is a full-time job with no payment. Flagship Initiative of the Government of India towards financial inclusion, namely the PMJDY (Pradhan Mantri Jan Dhan Yojana has played a vital role. Since the launch of the Pradhan Mantri Jan Dhan Yojana, there has been a rapid financial inclusion of women. Out of total savings accounts, there were overall 27 % female accounts in March 2014. However, under PMJDY, women accounts consist of 55 % of the total Jan Dhan accounts, 67 % of Jan Dhan accounts are in rural and semi-urban areas as of 18.08.2021. (Source PMJDY) Ministry of finance.

II. LITERATURE REVIEW

Apurva & Chauhan,(2013) Concluded that India is at a moderate level regarding financial inclusion as compared to other countries regarding number of branches ,ATMs, bank credit and bank deposits. RBI have adopted various strategies such as no-frill accounts, use of regional languages, simple KYC norms etc to strengthen financial inclusion.

By looking at the various milestones achieved by Axis Bank regarding financial inclusion, it can be said that banking sector plays vital role in promoting financial inclusion. To cope up with the challenges to spread financial inclusion , there is a need of viable and sustainable business models with focus on accessible and affordable products and processes , synergistic partnerships with technology service providers for efficient handling of low value, large volume transactions and appropriate regulatory and risk management policies that ensure financial inclusion .

Arpita Manta, (2014) Studied the extent to which financial inclusion for women has been taken place in India and the period of study was from 1996 to 2006 . There are unlimited opportunities to enhance the potential of women towards the direct contributors of economic growth but they are still the financially excluded lots and the northern region needs more attention.

Dr. B. Chinna Muthu and Prof. Anitharaj M.S. (2019) Financial Inclusion practices are quite challenging in the country like India where there are more economically deprived class people. Significant eliminations is possible due to Digitalized Financial Inclusion (DFI) approach as the access to technology is limited or restricted among particular sect of people. Rural India seems to be partially served with the high end facilities and services due to the discriminative and defective policies and programmes that is prevailing in Independent India .Hence, the Reserve Bank of India and Government of India should take necessary measures for the complete socio-economic inclusion at the earliest. Education and training programs for the illiterates and needy women population serves to be the need of the hour.

III. OBJECTIVES OF THE STUDY

- To determine different aspect of empowerment of Women through financial inclusion in Ranchi District.

- To make an evaluation of awareness and role played by financial inclusion schemes PMJDY, PMJJBY, SUI and API for benefits and upliftment of rural women.

- To identify the hindrances faced by women in accessing financial aids and services.

IV. RESEARCH METHODOLOGY

- Sample Size: For the purpose of the study I have collected data from 150 women respondents which constitute mostly Schedule Caste (SC), Schedule Tribe (ST) and Other Backward Classes (OBC) who belong to poor and marginalised class. This sample is the true representative of the universe.

- Sample Unit: Only women respondents have been taken for the research

- Sampling Technique: Random sampling Techniques and snowball technique since the data has been collected from Ranchi District sample size is 150.

- Methods of data collection: Primary Data refers to data collected for the first time and directly by the researcher. There are many different methods for primary data collection. The researcher has opted for a questionnaire. The questionnaire consists of 13 questions. The questions are based on knowledge about financial inclusion, and schemes started by the government of India for women empowerment through financial Inclusion. Secondary data has been collected from different journals, articles, and authentic papers that have been published. So researcher has used both primary as well as secondary data.

V. DATA ANALYSIS

- Q.1 Age Group

|

Age (years)

|

Frequency of respondents |

Percentage (%) |

|

18-28 |

45 |

30 |

|

29-39 |

60 |

40 |

|

39-49 |

27 |

18 |

|

Above 50 |

18 |

12 |

|

Total |

150 |

100 |

Source: Compiled by the researcher. The result depicts that 30 % are of 18-28 age group, 40 % are age group of 29-39 , 18 % are of 39-49 age group and 12 % are above 50.

2. Q.2 Educational Qualification

|

Educational Qualification |

Frequency of Respondents |

Percentage (%) |

|

Illiterate |

24 |

16 |

|

Up to Grade 5 |

30 |

20 |

|

Between 6-12 |

60 |

40 |

|

Graduation |

27 |

18 |

|

Post- Graduation |

9 |

6 |

|

Total |

150 |

100 |

Source: Compiled by the researcher the above chart depicts that majority 40% have educational background between 6-12 , 18% of the respondents have education up-to graduation , 16 % of the respondents are illiterate , 20 % of the respondents have educational background up-to Grade 5 and 6 % respondents have educational background up-to Post Graduation .

3. Q.3 Number of Family Members

|

Number of family Members |

Frequency of Respondents |

Percentage (%) |

|

Up to 4 members |

45 |

30 |

|

5-8 members |

72 |

48 |

|

More than 8 |

33 |

22 |

|

Total |

150 |

100 |

Source: Compiled by the searcher, table demonstrates that 30% have family members up to 4 members, 48 %have 5 to 8 members only 22% have more than 8 family members.

4. Q.4 Employment Status

|

Employment Status |

Frequency of Respondents |

Percentage |

|

Salaried(Govt/Private) |

11 |

7.3 |

|

Skilled Labour |

35 |

23.4 |

|

Self Employed |

42 |

28 |

|

Home maker |

54 |

36 |

|

Student |

8 |

5.3 |

|

Total |

150 |

100 |

Source : Compiled by the researcher the chart depicts that out of total 150 respondents 7.3% are salaried (government / private ), 23.4% are skilled worker , 28% are self employed, 36% are home maker and rest are students 5.3% are students .

5. Q.5 Do you have participation in Formal Financial Services?

|

Participation in Formal Financial Services |

Frequency of Respondents |

Percentage (%) |

|

Yes |

141 |

94 |

|

No |

9 |

6 |

|

Total |

150 |

100 |

Source: Compiled by the researcher this chart shows that 94% of the respondents have formal financial services only 6% of respondents does not have an formal financial service

6. Q.6 Usages of Banking Services

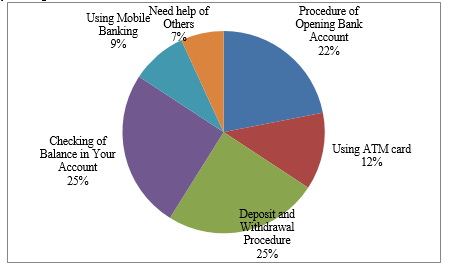

Source: Compiled by the researcher, 22% know the procedure of opening bank account, 25% of them can perform deposit and withdrawal procedure , 25% can check balance their account balance, 12% of them are able to use ATM cards, only 9% can perform mobile banking and rest 7% need help of others .

7. Q.7 Did you receive any training for formal baking services?

|

Training for Formal Banking Services |

Frequency of Respondents |

Percentage (%) |

|

Yes |

36 |

24 |

|

No |

114 |

76 |

|

Total |

150 |

100 |

Source : Compiled by the researcher the chart clearly depicts that only 24 % have receive training rest 76 % have not received any kind of training for banking services .

8. Q.8 What difficulties you encountered while receiving financial services?

|

Difficulties Encountered |

Frequency of respondents |

Percentage (%) |

|

Language Barrier |

33 |

22 |

|

Difficulty in Understanding technology |

30 |

20 |

|

Lack of awareness about Financial Services |

21 |

14 |

|

No difficulties |

66 |

44 |

|

Total |

150 |

100 |

Source : Compiled by the researcher the table demonstrate that 22 % face language barrier , 20% have difficulty in Understanding Technology, 14 % have lack of awareness about Financial Services , and 44% of them does not have any difficulties

9. Q.9 Awareness about PMJDY and different Financial Inclusion Schemes

|

Awareness about different Financial Schemes |

Frequency of Respondents |

Percentage (%) |

|

|

Pradhan Mantri Jan Dhan Yojana |

83 |

55.3 |

|

|

Pradhan Mantri Jivan Jyoti Bima Yojana |

22 |

14.7 |

|

|

Atal Pension Yojana |

9 |

6 |

|

|

Start Up India |

6 |

4 |

|

|

No Awareness |

30 |

20 |

|

|

Total

|

150

|

100

|

|

Source: Compiled by the researcher, the table depicts that 55.3 % have awareness about PMJDY, 14.7% are aware of PMJJBY, 6% about APY, and only 4% for Stand up India . 20% of them are still not aware of any schemes.

10. Q.10 Pradhan Mantri Jan Dhan Yojana Accounts per house hold

|

PMJDY accounts per house hold |

Frequency of Respondents |

Percentage (%) |

|

0 Members |

42 |

28 |

|

1 Members |

45 |

30 |

|

2 Members |

30 |

20 |

|

3 Members |

24 |

16 |

|

4 Members and greater |

9 |

6 |

|

Total |

150 |

100 |

Source: According to the pie chart created by the researcher, 28% of the respondents do not have a PMJDY account, but have a account in other banks, whereas 30% of the respondents have at least one family member who has a PMJDY account.

11. Q.11 Benefits received from Banking Sector?

|

Benefits received from Banking Sector |

Frequency of respondents |

Percentage (%) |

|

Yes |

141 |

94 |

|

No |

9 |

6 |

|

Total |

150 |

100 |

Source: The chart above, which was compiled by the researcher, indicates that 94 % of the respondents have gotten advantages from the banking industry. Still, 6% of those polled said they have not benefitted from the banking industry.

12. Q.12 Involvement in Decision Making

|

Involvement in Decision Making |

Frequency of Respondents |

Percentage(%) |

|

Yes |

130 |

86.7 |

|

No |

20 |

13.3 |

|

Total |

150 |

100 |

Source: Compiled by the researcher, the chart shows that due to financial inclusion 86.7% have involvement in decision making 13.3 %are still not involved for decision making.

13. Q.13 Additional Attribute got after financial inclusion

|

Additional Attribute Got |

Frequency of Respondents |

Percentage (%) |

|

Financial Empowerment |

39 |

26 |

|

Own Savings |

78 |

52 |

|

Help Others also |

26 |

17.3 |

|

Depend on others |

7 |

4.7 |

|

Total |

150 |

100 |

Source : Compiled by the researcher the chart depicts that due to financial inclusion women have received additional attribute, 26% have financial empowerment, 52% women have own savings,17.3 % of women are able to help other also and rest 4.7% of them are dependent on others for one or the other reasons

A. Correlation Testing

- Correlation between educational qualification, employment status, awareness about different financial inclusion schemes

|

TABLE 1. Correlations |

||||

|

|

Educational Qualification |

Employment |

Awareness about different financial inclusion schemes |

|

|

Educational Qualification |

Pearson Correlation |

1 |

.903** |

.810** |

|

Sig. (2-tailed) |

|

.000 |

.000 |

|

|

N |

150 |

150 |

150 |

|

|

Employment |

Pearson Correlation |

.903** |

1 |

.759** |

|

Sig. (2-tailed) |

.000 |

|

.000 |

|

|

N |

150 |

150 |

150 |

|

|

Awareness about different financial inclusion schemes |

Pearson Correlation |

.810** |

.759** |

1 |

|

Sig. (2-tailed) |

.000 |

.000 |

|

|

|

N |

150 |

150 |

150 |

|

|

**. Correlation is significant at the 0.01 level (2-tailed). |

||||

The correlation table shows, the results were statistically significant, strong positive correlation between educational qualification and employment status (r =.903, n=150, p < 0.001), strong positive correlation between Educational Qualification and awareness about different financial inclusion schemes (r = .810, n=150, p < 0.001).

B. Regression Testing

- Regression test of Participation in any form of financial services and Involvement in Decision making

|

Table 1. Model Summary |

||||

|

Model |

R |

R Square |

Adjusted R Square |

Std. Error of the Estimate |

|

1 |

.644a |

.415 |

.411 |

.262 |

|

a. Predictors: (Constant), Participation In any form of financial services |

||||

Table No.1 Shows that R square value is 0.415, which means that are independent variable i.e Participation in any form of financial services causes 41.5 % change in Involvement in Decision Making .

|

Table. 2 ANOVAa |

||||||

|

Model |

Sum of Squares |

df |

Mean Square |

F |

Sig. |

|

|

1 |

Regression |

7.191 |

1 |

7.191 |

104.945 |

.000b |

|

Residual |

10.142 |

148 |

.069 |

|

|

|

|

Total |

17.333 |

149 |

|

|

|

|

|

a. Dependent Variable: Involvement In Decision Making |

||||||

|

b. Predictors: (Constant), Participation In any form of financial services |

||||||

Table no. 2 ANOVA results shows that the p-value is .000 which is less than 0.001,hence we can say that there is significant relationship between our independent variable i.e Participation in any form of financial services and dependent variable i.e Involvement in decision making.

|

TABLE NO. 3 COEFFICIENTSA |

||||||||

|

Model |

Unstandardized Coefficients |

Standardized Coefficients |

t |

Sig. |

Collinearity Statistics |

|||

|

B |

Std. Error |

Beta |

Tolerance |

VIF |

||||

|

1 |

(Constant) |

.156 |

.098 |

|

1.596 |

.113 |

|

|

|

Participation In any form of financial services |

.922 |

.090 |

.644 |

10.244 |

.000 |

1.000 |

1.000 |

|

|

||||||||

Table no. 3 shows the coefficients results, this table indicates that the beta value is 0.644, which means that the change in independent variable i.e Participation in any form of formal financial services by one unit will bring about the change in the dependent variable i.e Involvement in decision making by 0.644units. Furthermore, the beta value is positive, which indicates the positive relationship between participation in any form of financial services and involvement in decision making. Or in other words, we can say that when participation in any form of financial services increase by one unit the Involvement in decision making will also increase by 0.644 units.

2. Regression Test of participation In any form of financial services and additional attribute got

|

TABLE NO. 1 MODEL SUMMARY |

||||

|

Model |

R |

R Square |

Adjusted R Square |

Std. Error of the Estimate |

|

1 |

.549a |

.301 |

.296 |

.676 |

|

a. Predictors: (Constant), Participation In any form of financial services |

||||

Table No.1 shows that R-square value is 0.301, which means that our Independent variable i.e Participation in any form of financial services causes 30.1% changes in the dependent variable i.e Additional Attribute Got.

|

TABLE. 2 ANOVAA |

||||||

|

Model |

Sum of Squares |

df |

Mean Square |

F |

Sig. |

|

|

1 |

Regression |

29.136 |

1 |

29.136 |

63.697 |

.000b |

|

Residual |

67.697 |

148 |

.457 |

|

|

|

|

Total |

96.833 |

149 |

|

|

|

|

|

a. Dependent Variable: Additional Attribute |

||||||

|

b. Predictors: (Constant), Participation In any form of financial services

|

||||||

Table No. 2 ANOVA results shows that p-value is 0.000 which is less than 0.001, hence we can say that there is significant relationship between Independent Variable i.e participation in any form of financial services and dependent variable i.e Additional attribute got .

|

TABLE NO. 3 COEFFICIENTSA |

||||||||

|

Model |

Unstandardized Coefficients |

Standardized Coefficients |

t |

Sig. |

Collinearity Statistics |

|||

|

B |

Std. Error |

Beta |

Tolerance |

VIF |

||||

|

1 |

(Constant) |

.066 |

.253 |

|

.262 |

.794 |

|

|

|

Participation In any form of financial services |

1.856 |

.233 |

.549 |

7.981 |

.000 |

1.000 |

1.000 |

|

|

a. Dependent Variable: Additional Attribute |

||||||||

|

Table No. 3 shows the coefficients results, it indicates that the beta value is 0.549 which means change in independent variable i.e Participation in any form of financial services by one unit will bring about change in the dependent variable i.e additional attribute got by 0.549 units . |

Positive Beta value also indicates that, there is a positive relationship between Participation in any form of financial services and Additional Attribute Got. Or we can also say that when Participation in any form of financial services increases by one unit the Additional attribute will also increase by 0.549 units.

VI. RESULT AND DISCUSSION

The researcher compiled a list of 13 questions to learn more about the influence of financial inclusion on women's empowerment and the challenges they encounter in accessing financial services. Financial inclusion has a favorable influence on women's empowerment, as seen in the tables above, and government measures to integrate disadvantaged groups, particularly women, in financial inclusion have been astonishingly successful. The analysis shows that women's participation in decision-making has grown, as well as an increase in personal savings, financial empowerment, and leadership abilities but more improvement need to done.

Despite all of the progress made women's access to institutional finance remains hampered by a lack of knowledge. To improve financial literacy, a baseline level of education is required.

The second impediment is lack of enough money women in rural areas have low source of income as a result active account are not very often used by the account holder, other major problem is rural women's reliance on men to conduct banking and financial transactions. The usage of technology financial services, such as automated teller machines (ATMs), internet banking, fund transfer and mobile banking, is the third barrier depicted by tables and diagrams, particularly for illiterate women. The researcher also highlights an essential fact about understanding of various financial inclusion schemes: the majority of women in rural regions are unaware of government-run financial inclusion programmes. In terms of awareness, women in rural areas are still marginalised and have a long way to go.

Conclusion

The researcher concluded that financial inclusion has a positive impact on women\'s empowerment. Women\'s basic level of education and financial literacy must be the first step in improving women\'s financial inclusion. Another notable effort that the Government of India can make is to involve women in different economic uplifment programmes and campaigns for financial inclusion schemes such as the Pradhan Mantri Jivan Jyoti Bima Yojana (PMJJBY), Atal Pension Yojana (APY), Pradhan Mantri Mudra Yojana (PMMY), Start Up India (SUI) in rural areas to receive benefits from the same and increase their source of income. Another step taken by the Indian government should be the proper utilisation of funds received from states and governments in the true sense. Regular monitoring will aid in tracking the benefits received from schemes as well as rectification of the problems encountered by account holders. Monitoring will also aid in the tracking of active accounts and accounts that aren\'t used very often.

References

[1] Dr. Bajpai,A.D.N. and Dr.Mishra S.K. (2007). Women Empowerment and Reproductive Behaviour.Classical Publishing Comapny. New Delhi ISBN: 81-7054-464-5 [2] Reddy, G.N.(2002).Empowering Women Through self Help Groups and Micro Credit. Journal of Rural Development, 21 (4): 511-535 [3] Chauhan, A. (2013).A Study on Overview of Financial Inclusion in India. Indian Journal of Applied Research, Volume: 3 (Issue :12 ), 351-352. [4] Dr. Balu, M.C. and Prof. Anitharaj M.S. (2019).‘ Exploring the Factors of Financial Inclusion and Women Empowerment In Rural Tamil Nadu .International Journal of Advance and innovative Research Vol 6, Issue 2 (ii) [5] Kabeer, N. (1999). ‘Resources, agency ,achievements : reflections on the measurement of women’s empowerment ‘ Development and Change Vol 30 () : 435-464 [6] Manta,A. (2014). Financial Deeping of Products and the Services for Women .The International Journal of Management , Vol 3 (Issue 1), 69-77. [7] Page, N and Cuba C.( 1999). Empowerment: What Is It?. Journal of Extension, Vol 37 [8] Raghuram G. Rajan ( 2009). A Hundred Small Steps – Report of the Committee on Financial Sector Reforms [9] Rangarajan C ( 2008) . Report of the Committee on Financial Inclusion, RBI. [10] Reserve Bank of India.(2015). Report of the Committee on Medium Term Path on Financial Inclusion .

Copyright

Copyright © 2022 Dr. Amar Kumar Chaudhary, Rinki Kumari. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET46423

Publish Date : 2022-08-22

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online