Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Impact of Indias Export on Indian GDP after Liberalisation

Authors: CA Naveen Kumar Tiwari

DOI Link: https://doi.org/10.22214/ijraset.2022.39792

Certificate: View Certificate

Abstract

Economic and political policy interventions were reflected on the economic development of the countries with respect to improving economic and social well-being of poor, market productivity and considerable growth rate in GDP. Specifically, in Indian context, these economic decisions have been a considerable influence on inclusive growth of the nation. It is evidence that India embarked on economic reforms in July, 1991, from the effect of a balance of payment crisis. The government initiated economic reforms basically is to provide an environment of sustainable growth and stability. Thereby the LPG (Liberalization, Privatization and Globalization) system has come to the picture for economic progress of the country. The present study investigates the linkage between foreign trade trends of India and its economic development in the light of economic reforms in India since 25 years (1991-2016). The outcomes of the study strongly support that there is a causal relationship between exports to GDP and GDP to exports and also causality between imports to exports in India.

Introduction

I. INTRODUCTION

India has been at the forefront of growth economies among the emerging nations around the world. The government of India has introduced new economic reforms in July 1991 mainly for economic progress of the country. Thus the reforms highly influenced on exchange rate system, improving the efficiency of state enterprises, up gradation of Indian stock market, encouragement of foreign participation in the domestic tertiary sector are considered important dimensions of economic reforms in the nation. Prior 1991 economic reforms, the Indian economy were closed due to unfair trade practices and the extensive quantitative trade restrictions on imports and exports of various business activities. And also foreign investment was strictly restricted to only allow Indian ownership of business. After introducing new economic reforms and LPG (Linearization, Privatization and Globalization) system have changed the face of the Indian trade practices and facilitate to remove trade barriers which shown a significant impact on India’s economy mainly due to increased foreign trade.

The economic reforms initiated in India in 1991 fundamentally focused on financial crisis management for addressing the issue regarding India’s balance of payments. It was also acknowledged that stabilization of macro-economic indicators would facilitate a solid foundation enduring structural economic reforms and thus speed up the economic growth of the country. This could be possible by removing the trade barriers and refining the competitive advantage for India’s products and services in international markets. This has resulted in Indian exports and imports increased steadily during this post- economic reforms period for the past 25 years (Satija, 2009).

Many previous researchers have investigated the impact of foreign trade on economic development in various emerging economies in the world. The previous studies (Katircioglu et al., 2007; Pradhan et al, 2015; Fathipour & Ghahremanlou, 2014; Silberberger & Koniger, 2016; Chandran & Nathan, 2015; Joshi, 2015; Quer et al., 2010; Menyah et al., 2014; Shirazi et al., 2004; Shahbaz& Rahman, 2014) empirical investigated that international trade practices shown great impact on countries economy. The export efficiency of the home country depends up on the factors include the technology advancement, infrastructure facilities, macroeconomic stability, political stability, productive capacity and transparent policy are the important indicators which boost up the exports of the nation and substantial gain foreign exchange further it promotes the economic development of the domestic country.

The present research attempts to capture the trends of foreign trade by considering the imports and exports performance and foreign currency inflows due to exports of the India’s in the 21st century focusing on the period 1991 – March 2015. This research has been structured as indicated: after an introductory section, literature review had been summarised. This is followed by the current status of India’s foreign trade, and then objectives of the study and the research methodology, theoretical framework and data source were presented. Subsequently, empirical results and discussion were presented. Finally, the research paper presents a conclusion regarding the relationship between GDP, exports and imports of products in India.

II. REVIEW OF LITERATURE

The fundamental question has been raised in the relevant empirical literature that how does India’s foreign trade effects on India’s’ GDP for economic development? In the context of existing study the present literature presents in the following aspects. A study by Katircioglu et al. (2007) assessed the long-run equilibrium association among financial development, real income growth and international trade in India. The results indicated that growth in international trade is aided by real income. This leads to progress in transnational trade activities that is exports and imports performance of the nation. Study by Pradhan et al. (2015) find the liaison between economic advancement and openness of trade post-globalization since 1990. The study had used Auto regressive distributing lag (ARDL) and vector auto regressive error correction model (VECM) approaches to find the impact. Indicators like the worth of exports as a percent of Gross Demotic Product (GDP), the quantum of imports as a percent of GDP and aggregate trade as a percent of GDP were considered for this study. The results demonstrated that openness of trade, stock market depth and banking sector depth were co integrated with the economic growth with the effect of a long-run equilibrium liaison among them. The study also found that openness of trade had exhibited a positive influence on economic growth. On the other hand Fathipour and Ghahremanlou (2014) examined the trade dealings between Iran and India during the period 2001 to 2010. The trade relations based on the competitive advantages between two countries that enabled to increase trade volume. The study found that the India imports mineral fuel from Iran and also India exports goods like chemicals, articles of iron, drugs and pharmaceuticals to Iran by importing and exports these goods leads to economic growth with effect of competitive advantage. The study by Silberberger and Koniger (2016) investigated the linkage between the quality of trade regulation and its bearing on economic progress in the context of international trade. The study provided evidence that both quality regulation frame work and internal trade favour a significant and positive stimulus on economic growth. Chandran and Nathan (2015) studied the impact of globalization on economic cooperation between two countries namely, Malaysia and India. The effect of globalization and economic policies of the both countries may stimulate the mutual trade relations and promoting the economic development of the nations. A study by Joshi (2015) focused on mutually beneficial trade relationship between India and Iran which could be offer a mutually beneficial situation for both the countries. The study divulges that the joint trade between the two republics grew considerably. India became a significant source for Iran’s imports with regards to trading of chemicals, man-made staple fibers, iron & steel products and cereals. Simultaneously, India offered a stable market for petroleum products to be exported from Iran at competitive international prices. Thus this serves as an evidential support India and Iran mutually gained from the strategic economic and trade relations On the other hand Quer et al. (2010) studied on comparing various trade related issues in China and India. The study reveals that China and India benefited from mutual trade and economic relations. China, enjoyed a higher advantage owing to its higher levels of amalgamation with the world economy coupled with its good physical infrastructure and a developmental model that creates a lot of employment opportunities. In the case of India, its undisputed position in ICT services, the flourishing private sector and stable environmental situation helped it in the trade relations with its strategic neighbor. Further, bilateral trade agreements further complemented the competitive advantage of both the nations.

III. RESEARCH GAP

It can be observed that the present literature examines the impact of foreign trade on economic development in India. But earlier studies have not captured the latest trends regarding foreign trade influence on the economic development in India. The present study aims to fill the gap by focusing on the India’s international trade (exports and imports) and its impact on the India’s GDP since 30 years’ post-economic reforms period.

IV. THE CURRENT STATUS OF INDIA’S FOREIGN TRADE

Table 1 below gives the current trends of India’s imports, exports, balance of trade movements of exchange rates. It can be observed that imports and exports increased steadily and it reveals that imports improved more rapidly than exports. Subsequent to economic reforms in the year 1991, imports were augmented by 12.7 % while exports improved only by 3.8% in 1992-93, which indicates that the domestic manufacturing sector in India were not able face the foreign competition by producing quality of goods and faces the inefficient productivity capacity and poor technology advancement. In 1995-96 imports increased by a huge 28.0 %, but exports were close to 20.8 per cent from 3.8 % in 1992-93. The movement of foreign exchange rate of Rupee to US$ slightly increased since 1991-92 (24.474) to still 2002-2003 (48.395). It started little increased in 2011-2012 (47.919) and in the year 2012-2013 it came close to 54.492.

Table 1: Trends in India’s International Trade Statistics (US$ million)

|

Year |

Exports |

Imports |

% of change in exports |

% of change in imports |

Trade Balance |

Exchange Rate of Rs. Vs US$ |

|

1991-92 |

17,865 |

19,411 |

-1.5 |

-19.4 |

-1546 |

24.474 |

|

1992-93 |

18,537 |

21,882 |

3.8 |

12.7 |

-3345 |

30.649 |

|

1993-94 |

22,238 |

23,306 |

20 |

6.5 |

-1068 |

31.366 |

|

1994-95 |

26,330 |

28,654 |

18.4 |

22.9 |

-2324 |

31.399 |

|

1995-96 |

31,797 |

36,678 |

20.8 |

28 |

-4881 |

33.449 |

|

1996-97 |

33,470 |

39,133 |

5.3 |

6.7 |

-5663 |

35.499 |

|

1997-98 |

35,006 |

41,484 |

4.6 |

6 |

-6478 |

37.165 |

|

1998-99 |

33,218 |

42,389 |

-5.1 |

2.2 |

-9171 |

42.071 |

|

1999-00 |

36,822 |

49,671 |

10.8 |

17.2 |

-12849 |

43.333 |

|

2000-01 |

44,076 |

49,975 |

19.7 |

0.6 |

-5899 |

45.684 |

|

2001-02 |

43,827 |

51,413 |

-0.6 |

2.9 |

-7587 |

47.692 |

|

2002-03 |

52,719 |

61,412 |

20.3 |

19.4 |

-8693 |

48.395 |

|

2003-04 |

63,843 |

78,149 |

21.1 |

27.3 |

-14307 |

45.952 |

|

2004-05 |

83,536 |

1,11,517 |

30.8 |

42.7 |

-27981 |

44.932 |

|

2005-06 |

1,03,091 |

1,49,166 |

23.4 |

33.8 |

-46075 |

44.273 |

|

2006-07 |

1,26,414 |

1,85,735 |

22.6 |

24.5 |

-59321 |

45.285 |

|

2007-08 |

1,63,132 |

2,51,654 |

29 |

35.5 |

-88522 |

40.261 |

|

2008-09 |

1,85,295 |

3,03,696 |

13.6 |

20.7 |

-118401 |

45.993 |

|

2009-10 |

1,78,751 |

2,88,373 |

-3.5 |

-5 |

-109621 |

47.417 |

|

2010-11 |

2,51,136 |

3,69,769 |

40.5 |

28.2 |

-118633 |

45.577 |

|

2011-12 |

3,04,624 |

4,89,181 |

21.3 |

32.3 |

-184558 |

47.919 |

|

2012-13 |

2,14,100 |

3,61,272 |

-5.5 |

-0.7 |

-147172 |

54.492 |

Source: https://data.gov.in/catalog/exports-imports-and-trade-balance.

V. TRENDS IN INDIA’S MAJOR EXPORT GOODS IN 1991-2015

Table 2 below gives the picture of India’s exports performance of different items during the post-economic reform period during the year 1991-2015. It can be confirmed that India’s exports to worldwide could be US$ 17899.89 Mil in 1991while this value had raised to US$ 264381 Mil in the year 2015. This significant raise was mainly due to there were considerably increased exports of capital goods, chemicals, fuels, metals and consumer goods to worldwide market. These five items dominated the India’s export performance during the year 2015. On the other hand, some of the items like ram materials, Intermediate goods; Vegetable, textiles and clothing were shown decline trend in exporting to world market period 1991 to 2015 respectively.

Table 2: Trends in India’s exports performance major commodities in 1991-2015 (US$ million)

|

Commodities |

1991 |

2015 |

% of share in 1991 |

% of share in 2015 |

|

Animal |

718.20 |

9,358.37 |

4.01 |

3.54 |

|

Capital goods |

1,113.08 |

36,384.13 |

6.22 |

13.76 |

|

Chemicals |

1,538.62 |

32,722.03 |

8.60 |

12.38 |

|

Consumer goods |

7,221.91 |

1,17,292.10 |

40.35 |

44.36 |

|

Food Products |

663.15 |

5,672.45 |

3.70 |

2.15 |

|

Footwear |

479.16 |

3,114.30 |

2.68 |

1.18 |

|

Fuels |

422.98 |

31,393.70 |

2.36 |

11.87 |

|

Hides and Skins |

841.12 |

3,524.42 |

4.70 |

1.33 |

|

Intermediate goods |

6,676.04 |

85,970.04 |

37.30 |

32.52 |

|

Mach and Elec |

867.35 |

21,165.34 |

4.85 |

8.01 |

|

Metals |

815.89 |

21,239.36 |

4.56 |

8.03 |

|

Minerals |

824.97 |

2,443.75 |

4.61 |

0.92 |

|

Miscellaneous |

411.67 |

7,116.44 |

2.30 |

2.69 |

|

Plastic or Rubber |

203.05 |

7,421.98 |

1.13 |

2.81 |

|

Raw materials |

2,567.06 |

21,816.23 |

14.34 |

8.25 |

|

Stone and Glass |

2,848.96 |

41,417.64 |

15.92 |

15.67 |

|

Textiles and Clothing |

4,882.67 |

37,161.71 |

27.28 |

14.06 |

|

Transportation |

497.41 |

22,013.91 |

2.78 |

8.33 |

|

Vegetable |

1,831.86 |

16,753.81 |

10.23 |

6.34 |

|

Wood |

52.85 |

1,861.80 |

0.30 |

0.70 |

|

All Products |

17,899.89 |

2,64,381.00 |

100.00 |

100.00 |

Source: World integrated trade solutions, 2015 and compiled by authors’

Also present in chart form one below shows the share of various export commodities to worldwide during the post-economic reform period 1991-2019 in US$ Mil.

VI. RESEARCH FRAME WORK AND HYPOTHESIS FORMULATION

Based on existing literature in the similar field, a conceptual frame work has been developed for the present study. This research frame work has been developed based on evidential support form few of the seminal work done in this field is a studies by Shirazi et al. (2004), Shahbaz and Rahman (2014), Katircioglu et al. (2007) and Pradhan et al. (2015) empirical investigated that export efficiency and international trade activities of the home country may enhance the economic growth rate. Based on these studies the general research framework has been developed which shows the significant relationships between India’s GDP (Dependent variable) and other four variables export products, import products, export partner and import partner are considered independent variables.

VII. RESEARCH HYPOTHESIS

Based on the seminal woks done in this field, the present study has been formulated and tested the following hypothesis.

- H1: Export Products have a significant impact on India’s GDP

- H2: Export Partners have a significant impact on India’s GDP

- H3: Import Products have a significant impact on India’s GDP

- H4: Import Partners have a significant impact on India’s GDP

- H5: No. of Tariff Agreement have a significant impact on India’s GDP

VIII. OBJECTIVES OF THE STUDY

This research paper examines the exports performance and its impact on India’s GDP during the post- economic reforms period 1991-2015.

IX. RESEARCH METHODOLOGY

The present study had employed multiple regression analysis to inspect the contributing factors of India’s GDP (dependent variable) for economic development of the nation. The econometric model has been developed for this study is given below.

ln GDP = α + β1 ln EXPPRODUCTS + β 2 ln EXPPARTNERS+ β3 ln IMPRTPRODUCTS + β4 ln IMPRTPARTNERS + β? ln NO. OFTARIFFAGREEMENT +ε

Where:

In GDP: natural logarithm of real GDP

InEXPRODUCTS: natural logarithm of real Export products InEXPPARTNERS: natural logarithm of real Export partners InIMPRTPRODUCTS: natural logarithm of real Import products InIMPRTPARTNERS: natural logarithm of real Import partners InTARIFF AREEMENT: natural logarithm of real tariff agreement

X. DATA SOURCE

This research draws secondary data based up on time-series data were obtained from the World Integrated Trade Solution (WITS) for Indian economy is annual figures pertaining to the period 1991-2015.

XI. VARIABLES USED

Therefore, to find the determinants of India’s GDP five variables are drawn for this study.

Table 3: Description of dependent and independent variables

|

S.No |

Variables |

Description |

|

Dependent Variables |

||

|

1 |

India’s GDP |

GDP(current US$ Million) |

|

Independent Variables |

||

|

2 |

Export products |

No. of export products |

|

3 |

Export partners |

No. of export partners |

|

4 |

Import products |

No. of import products |

|

5 |

Import partners |

No. of import partners |

|

6 |

Tariff |

No. of Tariff Agreement |

|

Source: World integrated trade solutions, 2015 |

||

XII. STATIONARY TEST

Before applying the regression analysis on time series or panel data, a stationary test had been conducted to assess the order of integration for each time series. In order to determine the co-integration, the Augmented Dickey-Fuller (ADF) and Philips-Perron (PP) unit root tests had been employed to check the integration level and the likely co-integration concerning the variables. The variables are GDP, number of export products, number of import products, export partners, import partners and number of tariff agreements to check for existence of a unit root. The below table 4, show the null hypothesis of unit root is rejected for first difference and level at 5per cent and 1 per cent statistically significant. If the null hypothesis is rejected that indicates the variables are in stationary form. The results of unit root tests are presented in below Table.4

Table 4: Results of the unit root test

|

Variables |

ADF unit root test(ADF) |

Philips-Perron unit root test(PP) |

Test for unit root |

||

|

Adj.t-stat |

P-value |

Adj.t-stat |

P-value |

||

|

GDP |

-4.184857 |

0.0162** |

-4.184857 |

0.0162** |

1st difference |

|

Export products |

-4.187394 |

0.0036*** |

-3.748787 |

0.0098*** |

Level |

|

Export partners |

-6.539249 |

0.0000*** |

-5.777282 |

0.0001*** |

Level |

|

Import products |

-3.675267 |

0.0451** |

-3.645415 |

0.0478** |

1st difference |

|

Import partners |

-5.979874 |

0.0003*** |

-6.186989 |

0.0002*** |

1st difference |

|

No. of Tariff Agreement |

-3.626363 |

0.0211*** |

-4.98118 |

0.0021 |

1st difference |

|

Note: p-value*** denotes significant at 1% level and p-value ** denotes significant at 5% level |

|||||

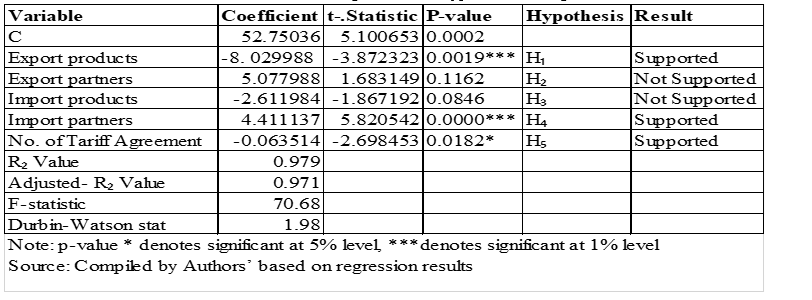

XIII. EMPIRICAL RESULTS AND DISCUSSION

This section discus the results of regression equation, it shows that significant impact of selected macroeconomic variables such as export products, export partner, import products and import partner on dependent variable of India’s GDP. Accordingly, the regression results confirm that export products of the country can be significantly association with India’s GDP further it leads to economic development of the nation. It is also possibly that high exports associated with economic development of the nations through gain foreign curry into home country. Theoretical and existing literature proved that the export performance of the may considerably affects the country economic development of the nation. According to Shirazi et al. (2004) confirmed that country exports give a boost to economic growth though access to wide range international markets and possible that earn foreign currency that may affect the country economic growth. Further the regression results show that import partners also show significant impact on India’ GDP. In the global business context, the import partner like Australia, Belgium, China, Germany, Iran, Japan, Nigeria, Saudi Arabia, United States, Switzerland, United Kingdom and United Arab Emirates are the major international business import partners for India. The statistical evidence shows that among the import partner the top import partner of the country is china, the per cent of import partner of the china is 12.68 per cent in the year 2014 and it has been raised 15.77 per cent during the year 2015. The second highest import partner is United States, the per cent of share in 2014 was 13.44 per cent and in the year 2015 it has raised to 15.25 per cent. Further the United Arab Emirates the partner share was 10.37 per cent in 2014 and 11.34 per cent in the year 2015 respectively.

The high F-Statistic and adjusted R2 confirm goodness of model fit for the regression analysis and further the Durbin-Watson test, which checks for serial correlations between variables and a value higher than 2 indicates negative correlation between adjacent residuals where as a value less than 2 indicates a positive correlation (Field, 2009). In this analysis Durbin- Watson statistic value 1.98 which is less than rule of thumb value i.e. 2 it shows the correlation among the variables. In these two cases the values are satisfactory and there are no issues regarding multiple regression analysis.

Table 5: Results of Regression and Hypothesis Testing

Conclusion

Foreign trade had become more important to Indian economy in the past few years. Exports and imports of services and goods have grown rapidly in the post-reforms period in India. The present study had explored possible co-integration, and direction of causality between gross domestic products, number of export products, number of import products in India using annual data that ranges from 1991-2015. The results of the research strongly support that there is causal relationship between export products, GDP, import partners of the country and number of tariff agreement. The Granger causality tests show that there is significant causality between export products to GDP, which leads to earn foreign currency and support the economic development of the nation. The study also found there is a causal relationship between the imports and exports, which result in boost the exports of the nation through importing of necessary raw material and purchase the innovative technology. According to Shirazi et al., (2004) imports play a significant role in exporting of services and goods. Imports of raw materials upsurge the value added products. The import of innovative technology increases the productivity and productive capacity that further accelerates the growth rate of the economy. Additionally, the study found that there is a casual relationship between the GDP and number of trade agreements. In conclusion, exports boost the country’s GDP which reflects on the growth of economy through the expansion into world markets and large economies of scale. It helps in higher earnings of foreign currency and further facilitates growth of the employment opportunities particularly in export sectors. Therefore, it is submitted that Indian may endure and capture the wider exports market in the world wide and also simultaneously may continue with the imports of necessary ram materials and innovative technology for improve the production capacity for accomplish the exports efficiency of the nation

References

[1] Chandran, S. D., & Nathan, K. S. (2015). Malaysia-India Economic Cooperation: Fixing the Jigsaw Puzzle. Procedia-Social and Behavioral Sciences, 172, 359-366. [2] Fathipour, G., & Ghahremanlou, A. (2014). Economical-Regional Integration-An Overview on Iran-India [3] Trade Relation. Procedia-Social and Behavioral Sciences, 157, 155-164. Gujarati, D. (1995). Basic Econometrics (3rd edition). New York: McGraw-Hill. [4] Joshi, R. M. (2015). India and Iran Trade: Issues and Challenges. Reintegrating Iran with the West: Challenges and Opportunities (International Business and Management, Volume 31) Emerald Group Publishing Limited, 31, 119-131. [5] Menyah, K., Nazlioglu, S., & Wolde-Rufael, Y. (2014). Financial development, trade openness and economic growth in African countries: New insights from a panel causality approach. Economic Modelling, 37, 386-394. [6] Pradhan, R. P., Arvin, M. B., & Norman, N. R. (2015). A quantitative assessment of the trade openness– economic growth nexus in India. International Journal of Commerce and Management, 25(3), 267-293. [7] Quer, D., Claver, E., & Rienda, L. (2010). Doing business in China and India: a comparative approach. Asia- Pacific Journal of Business Administration, 2(2), 153-166

Copyright

Copyright © 2022 CA Naveen Kumar Tiwari. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET39792

Publish Date : 2022-01-04

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online