Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Survey Paper on Credit card Fraud Detection System

Authors: K. Aditya Rao, Dr. Ganesh D

DOI Link: https://doi.org/10.22214/ijraset.2022.41524

Certificate: View Certificate

Abstract

Credit card fraud detection is presently the most frequently occurring problem in the present world. This is due to the rise in both online transactions and e-commerce platforms. Credit card fraud generally happens when the card was stolen for any of the unauthorized purposes or even when the fraudster uses the credit card information for his use. In the present world, we are facing a lot of credit card problems. To detect the fraudulent activities the credit card fraud detection system was introduced.

Introduction

I. INTRODUCTION

'Fraud' in credit card transactions is unauthorized and unwanted usage of an account by someone other than the owner of that account. Necessary prevention measures can be taken to stop this abuse and the behaviour of such fraudulent practices can be studied to minimize it and protect against similar occurrences in the future. In other words, Credit Card Fraud can be defined as a case where a person uses someone else’s credit card for personal reasons while the owner and the card issuing authorities are unaware of the fact that the card is being used.

Fraud detection involves monitoring the activities of populations of users in order to estimate, perceive or avoid objectionable behaviour, which consist of fraud, intrusion, and defaulting. This is a very relevant problem that demands the attention of communities such as machine learning and data science where the solution to this problem can be automated. This problem is particularly challenging from the perspective of learning, as it is characterized by various factors such as class imbalance. The number of valid transactions far outnumber fraudulent ones. Also, the transaction patterns often change their statistical properties over the course of time.

These are not the only challenges in the implementation of a real-world fraud detection system, however. In real world examples, the massive stream of payment requests is quickly scanned by automatic tools that determine which transactions to authorize. Machine learning algorithms are employed to analyse all the authorized transactions and report the suspicious ones. These reports are investigated by professionals who contact the cardholders to confirm if the transaction was genuine or fraudulent. The investigators provide a feedback to the automated system which is used to train and update the algorithm to eventually improve the fraud-detection performance over time.

II. LITERATURE REVIEW

Fraud act as the unlawful or criminal deception intended to result in financial or personal benefit. It is a deliberate act that is against the law, rule or policy with an aim to attain unauthorized financial benefit. Numerous literatures pertaining to anomaly or fraud detection in this domain have been published already and are available for public usage. A comprehensive survey conducted by Clifton Phua and his associates have revealed that techniques employed in this domain include data mining applications, automated fraud detection, adversarial detection.

In another paper, Suman, Research Scholar, GJUS&T at Hisar HCE presented techniques like Supervised and Unsupervised Learning for credit card fraud detection. Even though these methods and algorithms fetched an unexpected success in some areas, they failed to provide a permanent and consistent solution to fraud detection. A similar research domain was presented by Wen-Fang YU and Na Wang where they used Outlier mining, Outlier detection mining and Distance sum algorithms to accurately predict fraudulent transaction in an emulation experiment of credit card transaction data set of one certain commercial bank. Outlier mining is a field of data mining which is basically used in monetary and internet fields. It deals with detecting objects that are detached from the main system i.e. the transactions that aren’t genuine. They have taken attributes of customer’s behaviour and based on the value of those attributes they’ve calculated that distance between the observed value of that attribute and its predetermined value.

Unconventional techniques such as hybrid data mining/complex network classification algorithm is able to perceive illegal instances in an actual card transaction data set, based on network reconstruction algorithm that allows creating representations of the deviation of one instance from a reference group have proved efficient typically on medium sized online transaction. There have also been efforts to progress from a completely new aspect. Attempts have been made to improve the alertfeedback interaction in case of fraudulent transaction. In case of fraudulent transaction, the authorised system would be alerted and a feedback would be sent to deny the ongoing transaction. Artificial Genetic Algorithm, one of the approaches that shed new light in this domain, countered fraud from a different direction. It proved accurate in finding out the fraudulent transactions and minimizing the number of false alerts. Even though, it was accompanied by classification problem with variable misclassification costs.

III. METHODOLOGY

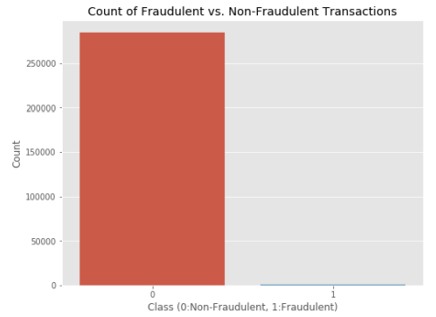

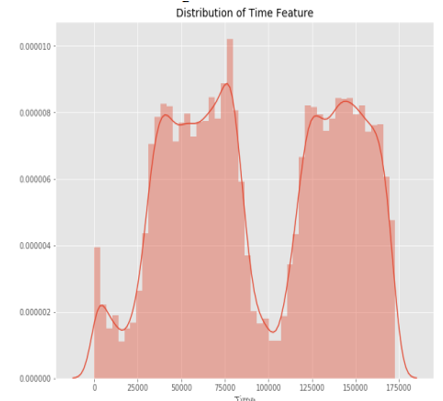

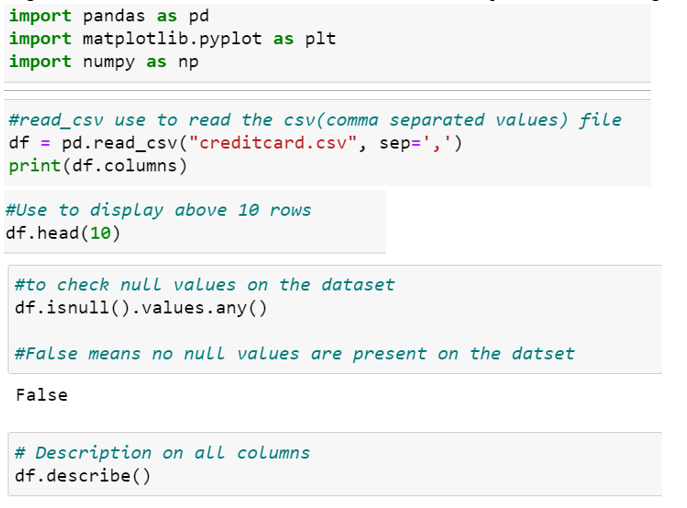

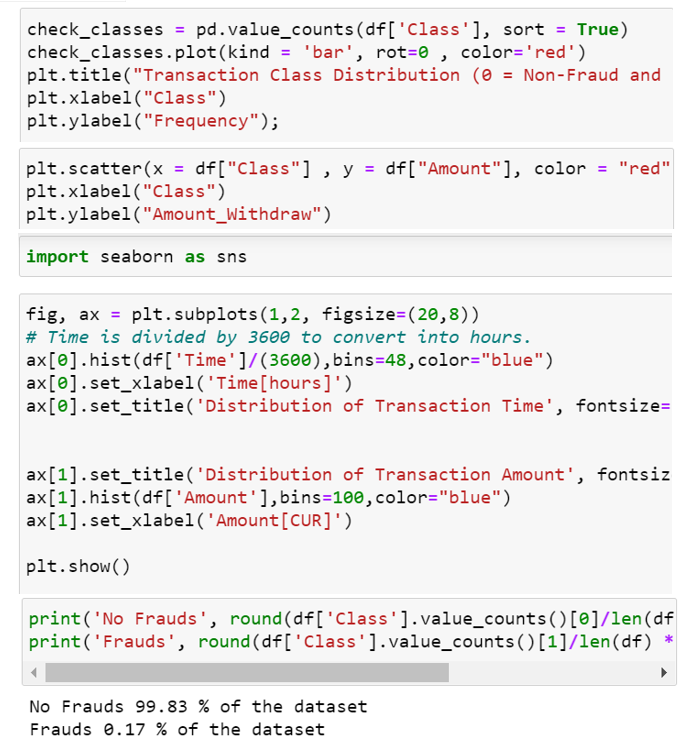

First of all, we obtained our dataset from Kaggle, a data analysis website which provides datasets. Inside this dataset, there are 31 columns out of which 28 are named as v1-v28 to protect sensitive data. The other columns represent Time, Amount and Class. Time shows the time gap between the first transaction and the following one. Amount is the amount of money transacted. Class 0 represents a valid transaction and 1 represents a fraudulent one. We plot different graphs to check for inconsistencies in the dataset and to visually comprehend it:

This graph shows that the number of fraudulent transactions is much lower than the legitimate ones. This graph shows the times at which transactions were done within two days. It can be seen that the least number of transactions were made during night time and highest during the days.

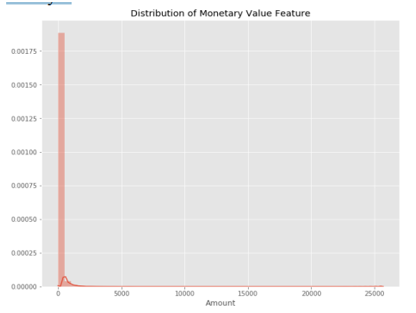

This graph represents the amount that was transacted. A majority of transactions are relatively small and only a handful of them come close to the maximum transacted amount. After checking this dataset, we plot a histogram for every column. This is done to get a graphical representation of the dataset which can be used to verify that there are no missing any values in the dataset. This is done to ensure that we don’t require any missing value imputation and the machine learning algorithms can process the dataset smoothly.

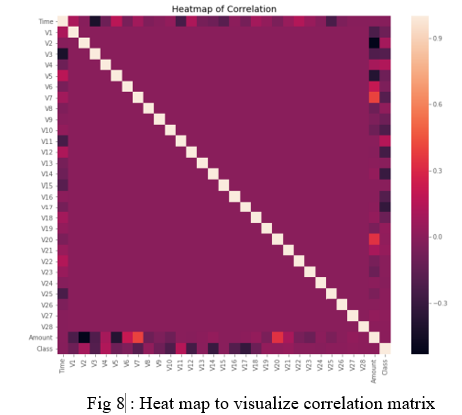

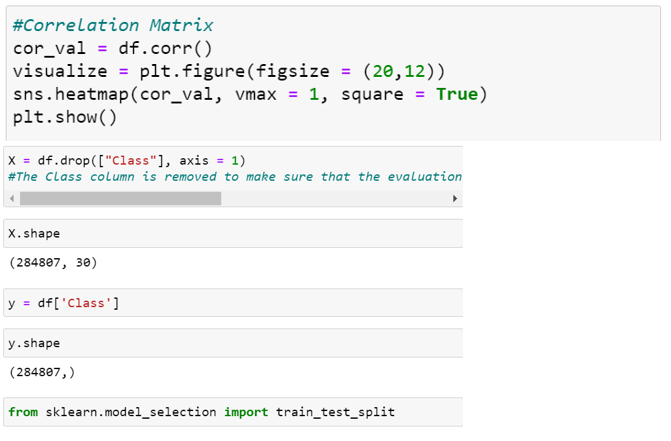

After this analysis, we plot a heatmap to get a coloured representation of the data and to study the correlation between out predicting variables and the class variable. This heatmap is shown below:

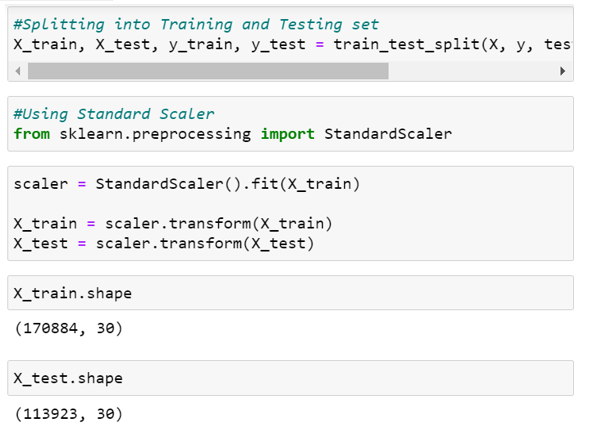

The dataset is now formatted and processed. The time and amount column are standardized and the Class column is removed to ensure fairness of evaluation. The data is processed by a set of algorithms from modules. The following module diagram explains how these algorithms work together: This data is fit into a model and the following outlier detection modules are applied on it:

- Naive Bayes: In this classification method, the probability of an object associated, with a particular category or class with certain feature is learned. Naive Bayes algorithm can fit model fast and provide high accuracy when applied to big data and need less training.

- Logistics Regression: Logistics Regression is less inclined to the overfitting, but it can overfit in high-dimensional datasets. We can consider regularization techniques to avoid overfitting. Any big outliers will be transform into the range of 0 and 1. Its help mainly to solve classifications problem and supply us the knowledge weather the event is happening or not.

- Random Forest: Firstly, we begin by choosing random samples from the dataset that is provided. Then, this algorithm will be used to create a decision tree for every sample that is generated. Then, the prediction result is found out for each decision tree. For each expected outcome, voting mechanism is carried out. Therefore, ultimately as the final prediction outcome the most voted prediction outcome is selected.

- AdaBoost: Adaboost or Adaptive Boosting, improve the performance of the weak classifier, here each instance in the training dataset is weighted.

- Hidden Markov Model (HMM): A Hidden Markov model is also described as double embedded stochastic process using which highly complex stochastic processes can be generated. Within the underlying framework, a Markov process that has an unnoticed stage is presumed to be available. The definite transformation of the state’s present inside the simpler Markov models is the only unknown parameters that are present.

- KNN Classifier: In the case of classification and regression KNN is generally the non-parametric algorithm that is used. The input of this algorithm consists of K-nearest training examples in the feature space for classification and regression whereas on the other hand, the output generally depends on whether the KNN belongs to classification category or regression category.

- Decision Tree: Decision tree is a tree shaped structure that expresses mainly independent attributes and dependent attributes and is a data mining technique. Classification rules that are derived from the decision trees are generally expressions of IF-THEN and each rule is needed to be produced, all the tests must succeed.

- Local Outlier Factor: Local Outlier Factor is an algorithm used for the identification of unattended outliers. It creates an anomaly score that reflects data points in the dataset that are outliers. It does this by calculating a given data points local density variance with respect to the data points around it

These algorithms are a part of sklearn. The ensemble module in the sklearn package includes ensemble-based methods and functions for the classification, regression and outlier detection. This free and open-source Python library is built using NumPy, SciPy and matplotlib modules which provides a lot of simple and efficient tools which can be used for data analysis and machine learning. It features various classification, clustering and regression algorithms and is designed to interoperate with the numerical and scientific libraries. We’ve used Jupyter Notebook platform to make a program in Python to demonstrate the approach that this paper suggests. This program can also be executed on the cloud using Google Collab platform which supports all python notebook files. Detailed explanations about the modules with pseudocodes for their algorithms and output graphs are given as follows: A. Local Outlier Factor It is an Unsupervised Outlier Detection algorithm. 'Local Outlier Factor' refers to the anomaly score of each sample. It measures the local deviation of the sample data with respect to its neighbours. More precisely, locality is given by k-nearest neighbours, whose distance is used to estimate the local data. The pseudocode for this algorithm is written as:

Partitioning them randomly produces shorter paths for anomalies. When a forest of random trees mutually produces shorter path lengths for specific samples, they are extremely likely to be anomalies. Once the anomalies are detected, the system can be used to report them to the concerned authorities. For testing purposes, we are comparing the outputs of these algorithms to determine their accuracy and precision.

About the dataset:

The datasets was first used in 2015, on the research paper “Calibrating Probability with Under sampling for Unbalanced Classi?cation” then it made available. This dataset presents transactions that occurred in two days, where we have 492 frauds out of 284,807 transactions. The dataset is highly unbalanced, the positive class (frauds) account for 0.172% of all transactions. It contains only numerical input variables, which are the result of a PCA transformation.

Unfortunately, due to confidentiality issues, we cannot provide the original features and more background information about the data. Features V1, V2, ... V28 are the principal components obtained with PCA. The only features that have not been transformed with PCA are 'Time' and 'Amount'. Feature 'Time' contains the seconds elapsed between each transaction and the first transaction in the dataset. The feature 'Amount' is the transaction Amount, this feature can be used for example-dependent cost sensitive learning. Feature 'Class' is the response variable and it takes value 1 in case of fraud and 0 in legit.

IV. DIFFICULTIES

- Imbalanced Data: Credit card fraud detection data has imbalanced nature. It means that very small percentages of all credit card transactions are fraudulent. This cause the detection of fraud transactions very difficult and imprecise.

- Different Misclassification Importance: In the fraud detection task, different misclassification errors have different importance. Misclassification of a normal transaction as fraud is not as harmful as detecting a fraud transaction as normal. Because in the first case the mistake in classification will be identified in further investigations.

- Overlapping Data: Many transactions may be considered fraudulent, while actually, they are normal (false positive) and reversely, a fraudulent transaction may also seem to be legitimate (false negative). Hence obtaining low rate of a false positive and false negative is a key challenge of fraud detection systems.

- Lack of Adaptability: Classification algorithms are usually faced with the problem of detecting new types of normal or fraudulent patterns. The supervised and unsupervised fraud detection systems are inefficient in detecting new patterns of normal and fraud behaviours respectively.

Conclusion

This method proves accurate in deducting fraudulent transaction and minimizing the number of false alert. While the algorithm does reach over 99.6% accuracy, its precision remains only at 28% when a tenth of the data set is taken into consideration. However, when the entire dataset is fed into the algorithm, the precision rises to 33%. This high percentage of accuracy is to be expected due to the huge imbalance between the number of valid and number of genuine transactions.

References

[1] “Credit Card Fraud Detection Based on Transaction Behaviour -by John Richard D. Kho, Larry A. Vea” published by Proc. of the 2017 IEEE Region 10 Conference (TENCON), Malaysia, November 5-8, 2017 [2] CLIFTON PHUA1, VINCENT LEE1, KATE SMITH1 & ROSS GAYLER2 “ A Comprehensive Survey of Data Mining-based Fraud Detection Research” published by School of Business Systems, Faculty of Information Technology, Monash University, Wellington Road, Clayton, Victoria 3800, Australia [3] “Survey Paper on Credit Card Fraud Detection by Suman” , Research Scholar, GJUS&T Hisar HCE, Sonepat published by International Journal of Advanced Research in Computer Engineering & Technology (IJARCET) Volume 3 Issue 3, March 2014

Copyright

Copyright © 2022 K. Aditya Rao, Dr. Ganesh D. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET41524

Publish Date : 2022-04-16

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online