Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Predictors of Customer Loyalty in Digital Banking among Indian Youth

Authors: Dr. R. Thiru Murugan, Prof. Dr. N. Ganga Vidya, Dr. S. Sundar

DOI Link: https://doi.org/10.22214/ijraset.2022.42344

Certificate: View Certificate

Abstract

Loyalty is a highly priced term as the market has one, too many of the same kind mushrooming with a very small variant on the unique selling proposition. This delta variant in the banking industry is called Internet Banking. You could use the same from any geography at any time and on any holiday in any currency. Now this kind of convenience is available in all segments of the service industry globally. All we want to understand is the customer loyalty of the generation born after the introduction of digital banking services in India. This generation never experienced the transition from a train to plane, landline to mobile, automatic to robotic, cash to digicash. The research investigates which factors are essential to build loyalty among these youth and new generation customers using internet banking. A questionnaire was developed and distributed to 328 youth between age 18 and 25 years. They were identified using convenience sampling. The results show that, perceived Ease of use, Attitude, Trust has high impact on Customer loyalty in new generation of Internet banking users.

Introduction

I. INTRODUCTION

In recent years the world economy has moved out through a maze of circumstances which are considered as one of the most important post-industrial revolution. Since the inception of online/virtual economy, internet has a heavy dominance over both banks and customers. The usage of Digital Banking has grown rapidly in the last decade along with the growth of Internet. In 1995 internet connection was less than 1%, today more than 60% of the world population access Internet (Internet World Stats, 2021). Only about 1% of Internet users did internet banking in 1998. This grew to 16.7% by March 2000. The number of internet users has increased tenfold from 1999 to 2019. Online banking users in India has reached a whooping ~ 200 million by 2021 post COVID-19 lockdown. The aim of this research is to analyze the people attitude and loyalty towards using digital Banking since the growth potential is so huge.

Table: 1.1: Financial Inclusion Factors

|

Factors |

Percentage (Female F Male M) |

|

Account with a Financial Institution |

79.8 (F – 76.6% M– 82.9%) |

|

Credit Card Ownership |

3.0 (F– 2.3% M – 3.7%) |

|

Debit Card Ownership |

32.7 (F – 22.3% M – 42.8%) |

|

Mobile Money Account |

2.0 (F– 76.6% M – 82.9) |

|

Digital Payments Transaction |

28.7 (F – 0.9% M – 3.1%) |

|

Online Purchase |

2.9 (F – 1.9% M – 3.8) |

|

Online Banking |

5.3 (F – 3.7% M – 6.8%) |

|

Online Bills Payments |

2.7 (F – 1.9% M – 3.5%) |

|

Source: https://datareportal.com/reports/digital-2022-india, attributed to WB |

|

In order to stimulate customers to use internet banking, banks must make key improvements that address the customers concerns. Therefore, it is necessary to understand the key factors that influence the customer loyalty of internet banking. Let us understand what other papers have discussed on this topic.

II. REVIEW OF LITERATURE

Beh Yin Yee and Faziharudean (2010), studied that the customer loyalty towards internet banking has become an issue due to stiff competition among the banks. Based on their findings, trust, habit, and reputation were found to have a significant influence on customer loyalty towards internet banking website in Malaysia. The three significant factors, reputation plays a stronger influence than trust and habit. The results also indicated that service quality and perceived was not significantly related to customer loyalty.

Wadie Nasri et al (2012), investigated that, factors influenced customer decision to adopt Internet banking. This research analyzed the different impact of privacy and security partly due to the high correlated between them. The result allows Banks have to improve the security and privacy to protect consumers which increase the trust of users. The Government should play a vital role to support banking industry by having a perfect law. The technology acceptance model explored the key factors that influence the Internet Banking. Gadget playfulness is the important factors that induced use of Internet Banking. It can easily capitalize on the internet convenience, simple technology functions. The result found that Perceived Ease of Use highly impacted on Computer play fullness.

Hung-Pin Shih (2004), defined the greater positive effect on perceived performance and perceived usefulness for internet banking to use. Internet banking will reduce costs and increase productivity. The results show that perceived ease of use influences user attitudes toward Internet use more than perceived usefulness. The Global System for Mobile Communication Association (GSMA) represents the interests of mobile operators worldwide, uniting more than 750 operators with nearly 400 companies in the broader mobile ecosystem, including handset and device makers, software companies, equipment providers and internet companies, as well as organizations in adjacent industry sectors. According their latest State of Mobile Connectivity 2021 report, the great COVID-19 pandemic taught even the unschooled how to learn technology at the fastest pace and hence we have over 658 million internet users (which is 60% of overall mobile users) in India as of February 2022. Now this is the right time to understand the exact trend of loyalty towards internet banking of this new generation inhouse groomed, entertained and schooled youth.

A. Research Objectives

- To determine the awareness and acceptance among the customer to use of digital banking.

- To identify the factors influencing the customer loyalty towards digital banking.

- To examine the impact of select demographic variables towards the customer loyalty of digital banking.

B. Hypothesis

H1-1 - Attitude has a positive impact on customer loyalty.

H1-2 – Perceived Ease of use has high influence on customer loyalty.

H1-3 - Gadget Playfulness has high influence on customer loyalty.

H1-4 – Perceived Usefulness has positive impact on customer loyalty.

H1-5 – Trust has high significant association with customer loyalty.

H2-1 – Perceived Ease of use has a positively impact on Attitude.

H2-2 – Gadget Playfulness has a highly impact on Attitude.

H2-3 – Perceived usefulness has a highly influence on attitude.

H2-4 – Trust has a directly influence on attitude.

H3-1 – Perceived usefulness has directly impact on trust.

H3-2 – Gadget Playfulness has directly impact on trust.

H3-3 – Perceived Ease of use has positively impact on trust.

III. RESEARCH METHODOLOGY

Banking industry is a service sector financial inclusion provider. Herein in order to understand customer loyalty to a very niche but no longer a luxury service of digital banking we learn the

- Attitude towards the concept of digital banking

- Trust on the safety and convenience provided

- Perceived Ease of Use of the online service

- Gadget Playfulness or the ergonomic comfort with which they pick up the gadget using skills

- Perceived Usefulness and the gratification they experienced.

- Finally as a summation of all the above how they become repeat customers and show Customer Loyalty.

We use a descriptive research design, to detail the market characteristics and acceptance.

A. Sample Methodology

This study has used convenience sampling of sample size 328 youth both gender from state of Tamil Nadu India. Alreck and Settle (1985) suggested that a sample of between 200 and 1,000 respondents for populations of 10,000 or more is preferable. Data forms were gathered online using Google forms.

IV. DATA ANALYSIS AND INTERPRETATION

The study uses Exploratory Factor Analysis (EFA) and listed

- Attitude towards the concept of digital banking

- Trust on the safety and convenience provided

- Perceived Ease of Use of the online service

- Gadget Playfulness or the ergonomic comfort with which they pick up the gadget using skills

- Perceived Usefulness and the gratification they experienced.

- Finally as a summation of all the above how they become repeat customers and show Customer Loyalty.

The next test applied was One-way ANOVA. It identified any existing significance with the homogenous group of each factor if there existed any difference due to genders, different levels of education or different levels of income.

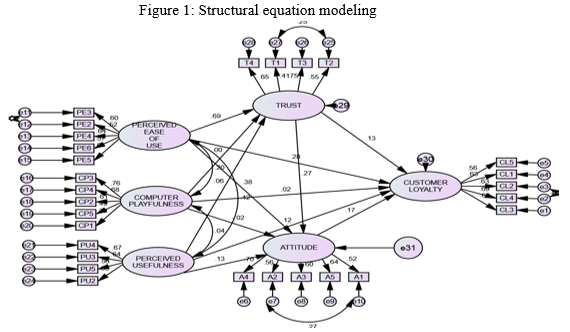

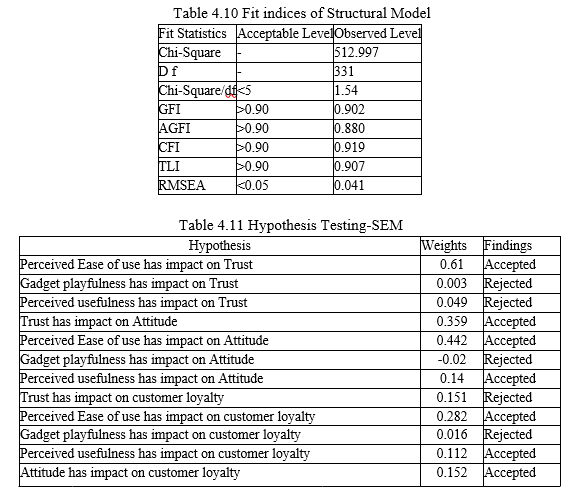

The last test applied was Structural Equation Modelling. This identifies the interrelationships if any between the dependent variable Customer loyalty and the independent variables – Attitude, Trust, Perceives Usefulness, Gadget Playfulness and Ease of Use of the platform or app.

A. Research Instruments

- Validity and Reliability: To reduce instrument error, we conducted content validity and reliability tests. The content validity ratio was applied to each item using the following formula from Lawsche (1975).

CVR = Ne-N/2 where Ne = Number of Panelists

---------

N2 N= 8

which was calculated based on the scores provided by a group of 8 panelists, for all the items in the questionnaire,

CVR for the items was more than 0.75(Lawsche 1975) taken as final instrument. This is calculated based on the ratings provided by a group of 8 participants on all items of the questionnaire Psychometric examinations are very important for behavioral research (Kerlinger 1986). Therefore, psychometric tests such as validity and reliability were performed on the instrument. Use Cronbach's alpha coefficient model (Cronbach 1951) to check for internal consistency between variables. Reliability of the factors was calculated by Cronbach’s alpha Coefficient which ranges from 0 to 1.

Values greater than 0.7 were used as a criterion to demonstrate internal consistency (Nunnally 2010, Hair et al. 2006). All factors studied, Customer loyalty, Attitude, Perceived Ease of Use, Gadget Playfulness Perceived Usefulness and Trust exceeded the cut-off value of 0.7. The reliability is shown in the table below.

Table 4.1: Reliability of The Factors

|

Factor |

Items |

Cronbach's Alpha(α) |

|

Customer loyalty |

5 |

0.753 |

|

Attitude |

5 |

0.751 |

|

Perceived Ease of Use |

5 |

0.738 |

|

Gadget Playfulness |

5 |

0.718 |

|

Perceived Usefulness |

4 |

0.707 |

|

Trust |

4 |

0.703 |

B. Exploratory Factor Analysis

The Exploratory Factor Analysis is a statistical method used to uncover the underlying structure of a relatively large set of variables. It is used to identify the underlying factors which influence customer loyalty towards Digital Banking. There is 5 variables related to the influence of loyalty towards digital banking. The Eigen Value is used more than or equal to 1 for each factor. The EFA was executed using Maximum Likelihood Analysis with promax rotation. Four items were removed from the total of 32-line items. Finally, 6 factors with 28 line items were extracted. The 52.765 percent of the total variance Explained.

Table 4.2: Exploratory Factor Analysis

|

Exploratory Factor Analysis (Promax Rotated) Results |

|||||||

|

Items |

Factor Loadings |

|

|||||

|

FACTOR1 |

FACTOR2 |

FACTOR3 |

FACTOR4 |

FACTOR5 |

FACTOR6 |

Factors |

|

|

CL3 |

.647 |

|

|

|

|

|

Customer Loyalty |

|

CL4 |

.638 |

|

|

|

|

|

|

|

CL2 |

.600 |

|

|

|

|

|

|

|

CL1 |

.593 |

|

|

|

|

|

|

|

CL5 |

.555 |

|

|

|

|

|

|

|

A4 |

|

.656 |

|

|

|

|

Attitude |

|

A2 |

|

.628 |

|

|

|

|

|

|

A3 |

|

.584 |

|

|

|

|

|

|

A5 |

|

.581 |

|

|

|

|

|

|

A1 |

|

.453 |

|

|

|

|

|

|

PE3 |

|

|

.662 |

|

|

|

Perceived Ease of Use |

|

PE2 |

|

|

.603 |

|

|

|

|

|

PE4 |

|

|

.469 |

|

|

|

|

|

PE6 |

|

|

.411 |

|

|

|

|

|

PE5 |

|

|

.400 |

|

|

|

|

|

CP3 |

|

|

|

.750 |

|

|

Gadget Playfulness |

|

CP4 |

|

|

|

.665 |

|

|

|

|

CP2 |

|

|

|

.587 |

|

|

|

|

CP5 |

|

|

|

.533 |

|

|

|

|

CP1 |

|

|

|

.424 |

|

|

|

|

PU4 |

|

|

|

|

.722 |

|

Perceived Usefulness |

|

PU3 |

|

|

|

|

.693 |

|

|

|

PU5 |

|

|

|

|

.532 |

|

|

|

PU2 |

|

|

|

|

.500 |

|

|

|

T2 |

|

|

|

|

|

.603 |

Trust |

|

T3 |

|

|

|

|

|

.527 |

|

|

T1 |

|

|

|

|

|

.516 |

|

|

T4 |

|

|

|

|

|

.437 |

|

Table 4.3: Eigen Values

|

FACTOR1 |

FACTOR2 |

FACTOR3 |

FACTOR4 |

FACTOR5 |

FACTOR6 |

|

|

Eigen Values |

6.004 |

2.412 |

1.801 |

1.754 |

1.477 |

1.328 |

|

Variance Explained |

21.444 |

8.613 |

6.432 |

6.263 |

5.274 |

4.743 |

|

Cumulative Variance Explained |

21.444 |

30.058 |

36.490 |

42.753 |

48.027 |

52.770 |

- One-Way ANOVA- Education Qualification

The results as depicted through Table 4. It highlights if there is any significant difference in customer loyalty, Perceived ease of use, Perceived Usefulness, Trust on Digital Banking through Education qualification.

Table 4.4: One Way ANOVA – Education

|

|

Sum of Squares |

d.f. |

Mean Square |

F |

Sig. |

|

|

Customer Loyalty |

Between Groups |

13.149 |

3 |

4.383 |

5.781 |

.001 |

|

Within Groups |

245.622 |

324 |

.758 |

|||

|

Perceived ease of use |

Between Groups |

5.824 |

3 |

1.941 |

2.491 |

.060 |

|

Within Groups |

252.505 |

324 |

.779 |

|||

|

Perceived Usefulness |

Between Groups |

6.231 |

3 |

2.077 |

2.799 |

.040 |

|

Within Groups |

240.386 |

324 |

.742 |

|||

|

Trust |

Between Groups |

8.183 |

3 |

2.728 |

3.883 |

.009 |

|

Within Groups |

227.583 |

324 |

.702 |

|||

From the above table one way ANOVA results shows that, the F-value of customer loyalty is 5.781 with degree of freedom of 3 and 324. The Results indicates that, @ 5% significance level, there is a significant difference between customer loyalty, perceived Usefulness, Trust and educational qualification on influencing the Digital Banking.

2. One Way ANOVA - Family Income

One-way ANOVA was tested if, there is any significant difference in customer loyalty, Attitude, Perceived ease of use, Trust and Family income on Digital Banking.

Table 4.5: One Way ANOVA - Family Income

|

|

Sum of Squares |

d.f. |

Mean Square |

F |

Sig. |

|

|

Customer Loyalty |

Between Groups |

14.873 |

4 |

3.718 |

4.924 |

.001 |

|

Within Groups |

243.897 |

323 |

.755 |

|||

|

Attitude |

Between Groups |

7.502 |

4 |

1.876 |

2.429 |

.048 |

|

Within Groups |

249.395 |

323 |

.772 |

|||

|

Perceived ease of use |

Between Groups |

7.968 |

4 |

1.992 |

2.570 |

.038 |

|

Within Groups |

250.362 |

323 |

.775 |

|||

|

Trust |

Between Groups |

5.703 |

4 |

1.426 |

2.002 |

.049 |

|

Within Groups |

230.062 |

323 |

.712 |

|||

From the above table one way ANOVA results shows that, the F-value of customer loyalty is 4.924 with degree of freedom of 4 and 323. The results show that @ 10% significance level, there is a significant difference between customer loyalty, attitude, perceived ease of use and Family income on Digital Banking.

3. One Way ANOVA –Gender

One-way ANOVA was used to test if there is any significant difference in customer loyalty, Attitude, Perceived ease of use, Perceived Usefulness on Digital Banking across gender.

Table 4.5: One Way ANOVA - Gender

|

|

Sum of Squares |

Df |

Mean Square |

F |

Sig. |

|

|

Customer Loyalty |

Between Groups |

17.249 |

3 |

5.750 |

7.713 |

.000 |

|

Within Groups |

241.521 |

324 |

.745 |

|||

|

Attitude |

Between Groups |

6.389 |

3 |

2.130 |

2.755 |

.043 |

|

Within Groups |

250.508 |

324 |

.773 |

|||

|

Perceived Ease of Use |

Between Groups |

7.031 |

3 |

2.344 |

3.022 |

.030 |

|

Within Groups |

251.298 |

324 |

.776 |

|||

|

Perceived Usefulness |

Between Groups |

7.267 |

3 |

2.422 |

3.279 |

.021 |

|

Within Groups |

239.350 |

324 |

.739 |

|||

From the above table one way ANOVA results shows that, the F-value of customer loyalty is 7.713 with degree of freedom of 3 and 324 at 5% significance level. The Results indicates that there is significance difference between customer loyalty, Attitude, Perceived ease of use, Perceived Usefulness on Digital Banking across gender.

4. Multiple Regression

Regression is a tool used to analyze the factors influence (independent variables) on customer loyalty dependent variable). Firstly, from the above table, the results shows that R square value is 0.403 which shows that 40.3% impact on customer loyalty in digital banking among college students. Secondly, the ANOVA Table indicates that the significance value is .000 which is less than 0.05. It shows that there is significance difference between customer loyalty (dependent variable) and Attitude, Perceived ease of use, gadget playfulness, and perceived usefulness, trust (independent variable). Thirdly, the coefficients Table shows that, the significance value of attitude, perceived ease of use, perceived usefulness, trust which (p<0.05). So, the hypothesis, H1-, H1-2, H1-4, H1-5 is supported, which indicates effect of attitude, perceived ease of use, perceived usefulness, trust has impact on customer loyalty in internet Banking. The significance value of Gadget Playfulness is .358 which is insignificant. So, the hypothesis, H1-3 is not supported.

Table 4.6 Regression-Customer Loyalty

|

R |

R Square |

Adjusted R Square |

Std. Error of the Estimate |

|||||||

|

.635 |

.403 |

.394 |

.692 |

|||||||

|

ANOVA |

||||||||||

|

Model |

Sum of Squares |

Df |

Mean Square |

F |

Sig. |

|||||

|

Regression |

104.309 |

5 |

20.862 |

43.490 |

.000 |

|||||

|

Residual |

154.462 |

322 |

.480 |

|

|

|||||

|

Total |

258.770 |

327 |

|

|

|

|||||

|

Coefficients |

||||||||||

|

Model |

Unstandardized Coefficients |

Standardized Coefficients |

T |

Sig. |

||||||

|

B |

Std. Error |

Beta |

||||||||

|

Attitude |

.128 |

.059 |

.128 |

2.175 |

.030 |

|||||

|

Perceived Ease of Use |

.313 |

.062 |

.313 |

5.078 |

.000 |

|||||

|

Gadget Playfulness |

-.041 |

.044 |

.041 |

.921 |

.358 |

|||||

|

Perceived Usefulness |

.148 |

.051 |

.144 |

2.916 |

.004 |

|||||

|

Trust |

.222 |

.057 |

.212 |

3.911 |

.000 |

|||||

|

a. Dependent Variable: Customer Loyalty |

||||||||||

5. Multiple Regression-Attitude

Multiplied Regression used to analyze the factors influence (independent variable) on Attitude (dependent variable). Firstly, from the above table, the results shows that R square value is 0.464 which shows that 46.4% impact on internet banking among college students. Second, the ANOVA Table indicates that the significance value is .000 which is less than 0.05. It shows that there is significance difference between Attitude (dependent variable) and Perceived ease of use, gadget playfulness, perceived usefulness, trust, (independent variable). Thirdly, the coefficients Table shows that,5% the Significance level of perceived ease of use, perceived usefulness, Trust (p<0.05). So, the hypothesis is H2-1, H2-3, H2-4 is supported. The significance value of gadget playfulness is (.754) which is more than 0.05. So the hypothesis, H2-2 is not supported. The first factor influencing Attitude (dependent variable) is perceived ease of use. The beta value is 0.443which shows that when the customer attitude influencing based on the perceived ease of use. Trust, beta value is (.206) which says that it is the second least factor influencing attitude in internet banking.

Table 4.7 Regression-Attitude

|

Model |

R |

R Square |

Adjusted R Square |

Std. Error of the Estimate |

||

|

1 |

.681a |

.464 |

.457 |

.65314826 |

||

|

ANOVA |

||||||

|

Model |

Sum of Squares |

Df |

Mean Square |

F |

Sig. |

|

|

1 |

Regression |

119.105 |

4 |

29.776 |

69.798 |

.000 |

|

Residual |

137.793 |

323 |

.427 |

|

|

|

|

Total |

256.897 |

327 |

|

|

|

|

|

Model |

Unstandardized Coefficients |

Standardized Coefficients |

T |

Sig. |

||

|

B |

Std. Error |

Beta |

||||

|

1 |

Perceived Ease of Use |

.442 |

.053 |

.443 |

8.401 |

.000 |

|

Gadget Playfulness |

-.013 |

.042 |

.013 |

.314 |

.754 |

|

|

Perceived Usefulness |

.180 |

.047 |

.176 |

3.845 |

.000 |

|

|

Trust |

.215 |

.052 |

.206 |

4.120 |

.000 |

|

6. Multiple Regression-Trust

Multiple Regression is used to analyze the factors influence (independent variable on Trust (dependent variable). Firstly, from the above table, the results shows that R square value is 0.333 which shows that 33.3% impact on internet banking among college students. Second, the ANOVA Table indicates that the significance value is .000 which is (p<0.05). It shows that there is significance difference between trust (dependent variable) and Perceived ease of use, gadget playfulness, perceived usefulness, (independent variable). Thirdly, the coefficients Table shows that, 5% the Significance level of perceived ease of use, perceived usefulness. So, the hypothesis, H3-3, H3-1, H3-2 is supported perceived usefulness (.013) (p<0.05). So, the hypothesis, H3-1 is supported. The first factor influencing Trust (dependent variable) is perceived ease of use. The beta value is 0.508 which shows that when the customer trust also influencing based on the perceived ease of use. Perceived usefulness, beta value is (.126) which says that it is the second least factor influencing trust in internet banking among college students.

Table 4.8 Regression-Customer Loyalty

|

Model |

R |

R Square |

Adjusted R Square |

Std. Error of the Estimate |

|

|

|

1 |

.577a |

.333 |

.327 |

.69666938 |

|

|

|

ANOVA |

|

|||||

|

Model |

Sum of Squares |

Df |

Mean Square |

F |

Sig. |

|

|

1 |

Regression |

78.513 |

3 |

26.171 |

53.922 |

.000b |

|

Residual |

157.253 |

324 |

.485 |

|

|

|

|

Total |

235.766 |

327 |

|

|

|

|

|

Model |

Unstandardized Coefficients |

Standardized Coefficients |

t |

Sig. |

||

|

B |

Std. Error |

Beta |

||||

|

1 |

(Constant) |

1.653E-016 |

.038 |

|

.000 |

1.000 |

|

Perceived Ease of Use |

.485 |

.049 |

.508 |

9.845 |

.000 |

|

|

Gadget Playfulness |

.015 |

.045 |

.015 |

.332 |

.740 |

|

|

Perceived Usefulness |

.123 |

.049 |

.126 |

2.496 |

.013 |

|

Table 4.9: Hypothesis Testing Results

|

Hypothesis No. |

Hypothesis |

Results |

|

H1-1 |

Attitude has a positive impact on customer loyalty |

Supported |

|

H1-2 |

Perceived Ease of use has a highly influence on customer loyalty. |

Supported |

|

H1-3 |

Gadget Playfulness has no influence on customer loyalty. |

Not Supported |

|

H1-4 |

Perceived Usefulness has a positively impact on customer loyalty. |

Supported |

|

H1-5 |

Trust has a highly significant association with customer loyalty. |

Supported |

|

H2-1 |

Perceived Ease of use has a positively impact on Attitude. |

Supported |

|

H2-2 |

Gadget Playfulness has no impact on Attitude. |

Not Supported |

|

H2-3 |

Perceived usefulness has a highly influence on attitude. |

Supported |

|

H2-4 |

Trust has a directly influence on attitude. |

Supported |

|

H3-1 |

Perceived usefulness has directly impact on trust. |

Supported |

|

H3-2 |

Gadget Playfulness has no impact on trust |

Not Supported |

|

H3-3 |

Perceived Ease of use has positively impact on trust. |

Supported |

7. Structural Equation Modelling

By using the user-friendly software Amos 20.0 the proposed research model was tested using a graphical diagram. The common model-Fit model indices were used to evaluate the overall goodness fit of the model, namely Chi-Square, Degree of freedom, GFI, AGFI, CFI, TLI, RMSEA, and RMSR. The value of Chi-square = 512.997, Df = 331, GFI = .902, AGFI= 0.88, CFI= 0.919, TLI= 0.907, RMSEA= 0.041.

Thus, SEM has acted as a system for specifying the interrelationship among observed and latent variables with great specification as a much simpler model than most other tools such as correlation and multiple regression.

V. IMPLICATION

This study is to identify the factors influencing customer loyalty in internet banking among college students. Perceived Ease of use, Trust, Attitude were considered most significant factors influencing customer loyalty in internet banking. The Research findings reveal that students know more aware of the services, but still many people not using these services. Nowadays people are more using the E-commerce and they are purchasing the goods, but internet banking is the risky one. Bank should provide the best services and good quality manner. They have to initiate that to educate the people about the internet banking. Internet banking has to improve the security, make an as simple process to use the internet banking. The customer data should not be leaked, Bank must take the responsibility and solve those kinds of issues. The bank should consider reducing the service charge. The service charge is one of the parts to attract the customer. Those points are respondent gives to influencing the customer loyalty in internet banking. The SEM analysis finds that the Perceived ease of use leads to trust. Trust, Perceived ease of use and Perceived usefulness has more influence on Attitude, whereas Attitude and Perceived ease of use lead to customer loyalty. Perceived Ease of use and Attitude was the significant predicators of customer loyalty to the usage of internet banking services.

Conclusion

Digital banking has become a vital part of everyday life for the z next generation. It has improved the user attitude in many ways for the financial transaction. Internet banking allows them to perform a wide range of banking transaction electronically. The young generation will move towards a cash less environment. The cashless transactions are widely accepted now into deep rural pockets of India. This study concluded that ease of use and attitude towards digital financial transaction are the biggest motivators. COVID-19 has accelerated the move to digital services for organizations in all sectors, and increased the attractiveness of check and play and download and pay. In today’s interconnected world, banking sector has to reinvent itself and become part of other industries, rather than be a stand-alone industry. There exists no longer a competition among banks. All that exists now is the comparison of who excels in providing a higher ease of use technology to handle money. The customers prefer moving out to the new embedded platform because it means simpler and more affordable solutions at the touch of a button, at a moment when it is most relevant. Banking industry is now an essential add on to every other sector. Moving ahead Digi-cash has its new baby the crypto-currency which all the more means the banking industry platforms will all now be again moved to Blockchain technology and Artificial Intelligence platforms and then people will simply swipe their mobile phones and pay in India too. Currently South Korea is way ahead and works with 5 G and mobile cash payments with just one tap of a mobile. Already WIFI tap cards are in vogue here in India. All these only mean the reason for customer loyalty is purely driven by the most powerful technology with the best ease of use and no longer the Bank.

References

[1] Cronbach, L. J. (1951). Coefficient alpha and the internal structure of tests. psychometrika, 16(3), 297-334. [2] GSM Association - The State of Mobile Connectivity Report 2021 [3] Hair. J.F., Black. C.W., Babin. J.B., Anderson. R.E. and Tatham. L.R. (2006) Multivariate Data Analysis, Pearson Edu Inc. USA. [4] https://datareportal.com/reports/digital-2022-india, attributed to World Bank. Slide number 83 [5] https://www.internetworldstats.com/stats.htm [6] Kerlinger. F. N. (1986) Foundations of behavioral research, Orlando FL: Harcourt Brace and Company, USA. [7] Lawsche. C. H. (1975) “A quantitative approach to content validity”, Personnel Psychology, 28 (4), 563-575. [8] Nasri, W., & Charfeddine, L. (2012). Factors affecting the adoption of Internet banking in Tunisia: An integration theory of acceptance model and theory of planned behavior. The Journal of High Technology Management Research, 23(1), 1-14. [9] Shih, H. P. (2004). Extended technology acceptance model of Internet utilization behavior. Information & Management, 41(6), 719-729. [10] Tripathi, S., et al. \"Encashing on Digital: Financial Services in 2020.\" (2017). [11] Yee, Beh Yin and Faziharudean, T.M., 2010. Factors affecting customer loyalty of using Internet banking in Malaysia. Journal of Electronic Banking Systems, 21.

Copyright

Copyright © 2022 Dr. R. Thiru Murugan, Prof. Dr. N. Ganga Vidya, Dr. S. Sundar. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET42344

Publish Date : 2022-05-07

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online