Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Strategic Partnership of a Consulting Organization with a Client as a Perspective for the Development of Investment Consulting

Authors: Sabirova Lola Shavkatovna , Shaislamova Nargiza Kabilovna

DOI Link: https://doi.org/10.22214/ijraset.2023.49272

Certificate: View Certificate

Abstract

The article examines the foreign experience and the national practice of consulting firms. In order to implement a successful, throughout the entire length, investment process, the authors justify the need for strategic interaction of consultants with clients by considering the created product and profit as a joint result of the activities of both parties.

Introduction

I. INTRODUCTION

Socio-economic growth is impossible without large-scale investment, which implies investing in the creation of an object of investment activity, as well as a set of practical actions of persons involved in this process.

The market economy opens up many opportunities for investment. However, business entities have both a limited amount of free financial resources available for investment and insufficient knowledge for the implementation of investment ideas and, moreover, theoretical and practical skills for effective management of the investment process at the stages of its implementation. The main reasons why company executives hire consultants are the need to: get an objective assessment of problems and tasks; benefit from the knowledge and experience of consultants; attract additional resources to solve specific problems.

Since business entities are constantly faced with the problems of successfully developing their business: developing an investment strategy, finding sources of financing for projects, determining their optimal structure, and others, where the consulting services of specialists come to the fore, the choice of the topic of the article in today’s conditions of economic development of the Republic of Uzbekistan seems to be very relevant.

II. LITERATURE REVIEW

The recent growth in investment consulting has prompted great attention from scholars and practitioners to the problems of its development and its effects on the investment activities of organizations.

The matter of developing consulting services to address certain management activities has gained recognition in both foreign and Commonwealth of Independent States countries.

According to Steele “consulting” is “any form of providing help on the content, process, or structure of a task or series of tasks, where the consultant is not actually responsible for doing the task itself but is helping those who are.”[1]

A commission of experts in the USA has defined “management consulting” as “an independent and objective advisory service provided by qualified persons to clients in order to help them identify and analyze management problems or opportunities. Management consultants also recommend solutions or suggested actions with respect to these issues and help, when requested, in their implementation.” [2] The definition of the role of consulting services, from the point of view of the patterns of formation of the prospects for the growth of an enterprise, is reflected in the work of Tabachnikova [3], who considers the very appearance of specialists who can assist in the management of investment activities and in the formation of competitive business mechanisms to be natural, important for development investment area. “In fact, consultants bring “fresh (innovative) thought, forcing the management of enterprises to take a fresh look at the processes taking place in the investment sphere of the enterprise they manage.” According to the scientist, they are assigned the role “not only in solving specific problems of managing the investment sphere, but also in increasing the overall efficiency of the enterprise's business activity ...”

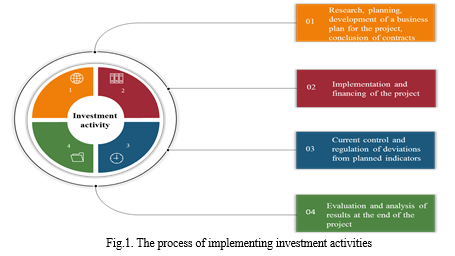

In fact, we are talking about the need for interaction between consulting companies and enterprises-users of services in applying in practice the rich experience of market civilization at the well-known 4 stages of investment activity, represented in figure-1.

Another Russian scientist A.S. Zhelonkina wrote in her scientific works that the so-called “entrepreneurial approach” of a client organization to working with a consultant consists in the ability to obtain and effectively use the knowledge of expert consultants on issues such as financial management, support of investment projects . The positive aspect of such support is that in this way an entrepreneur can make strategic decisions and, at the same time, pass through a large amount of knowledge of an expert consultant [4].

E.Melyakova considers the role of consulting firms already wider, as the basis for the growth of economic well-being and social satisfaction of the population [5].

Unlike the expert who solves a problem on his own, the work of a consultant is characterized by interaction with the client in solving the problem [6]. This interaction is reflected, on the one hand, in the consultant’s understanding of the client’s affairs and, on the other hand, in the collaboration between consultant and client.

In 1982, Turner presented a hierarchy of eight levels that illustrate the consulting tasks in a differentiated manner thereby contributing to an even more detailed definition [7]:

- Information conveyance;

- Diagnosis of current state to redefine the problem;

- Problem resolution;

- Recommendations for action based on the diagnosis;

- Implementation support;

- Development of a joint understanding and commitment;

- Support for organizational learning;

- Permanent improvement of organizational effectiveness.

Thus, taking into account the importance of consulting activities, additional research is required to optimize the interaction between customer enterprises and investment consultants.

III. RESEARCH METHODOLOGY

The research methodology is based on the scientific works of foreign researchers devoted to the theory and practice of managing the investment sphere of an enterprise in market conditions, as well as domestic practice of consulting activities, using such methods of economic research as observation and collection of facts, the method of analysis and synthesis, comparison, and as well as a systematic approach.

IV. DISCUSSION AND RESULTS

An investment consultant assists clients with formulating and executing strategies for investing, creating and maintaining their portfolios, and monitoring investments. A collegiate degree is usually necessary, as well as prior experience, and consultants must also hold a proper license in order to advise clients.

An investment consultant assists their clients in establishing an investment portfolio. This can involve individuals, small firms, and even big corporations. They assess the client's current financial standing and create a strategy to fulfill their goals. Tasks they must perform include overseeing the investments and keeping constant watch as the client's financial goals evolve. Many consultants build up a close rapport with the clients they work with, as their work entails ongoing contact with them.

Financial professionals in the financial services industry can be found working in banks, asset management firms, private investment companies, and they may even work as independent consultants. Their key roles are to provide essential advice to clients to better their finances, with expertise in tax and estate planning, asset allocation, risk management, education savings, and retirement planning. Professionals in this field can be classified into financial advisors, portfolio managers, independent money managers, and financial planners. Investment consultants may fall into four main categories:

- Registered Representatives: They are investment advisers, such as stockbrokers and banking representatives, who are compensated for selling investment and insurance goods. They work for sell-side firms, which are financial institutions that originate, promote, and sell financial derivatives. Typically, registered representatives hold a Series 6 or Series 7 license.

- Financial Planners: Financial planners are investment experts who handle their clients' personal finances. They may create a financial plan to assist a client in paying for college tuition. Certified financial planners (CFPs), certified public accountants (CPAs), and personal financial specialists (PFSs) are examples of qualified financial planners.

- Financial Advisors: These financial advisors provide both basic and personalized financial advice. They are paid through collecting fees and often hold a Series 65 or Series 66 license.

- Money Managers: Money managers are investment consultants who make investment decisions on behalf of their clients. Money managers work for buy-side corporations including asset management companies, fund managers, and hedge funds.

For a deeper understanding of consulting in general, it is advisable to take a look at the roles [8]. Since it is not expedient or even possible in the framework of this study to enumerate all the possible roles of consultants as “the list of roles is endless”, [9] the following figure-2 offers an integrative observation of roles, functions, and tasks of consultants.

|

|

Types of consultation |

|||

|

Instrumental |

Conceptional |

Symbolic |

||

|

Consulting commitment aims |

Consulting tasks |

•Information delivery and intermediation •Recommended commitment based on diagnosis •Supporting implementation |

•Support with organisational learning •Improving organizational effectivity •Developing comprehension/ commitment |

•Problem solving •Situational diagnosis for problem redefinition |

|

Consulting functions |

•Management function •Reorganization function •Staff function |

•Orientating function •Intervening function •Moderating function |

•Political function •Implementation function •Legitimation function •Interpretational functio |

|

|

Consulting roles |

•Information provider •Realizer •Crisis manager

|

•Management coach •Change agent •Process promoter |

•Katalysator •Externer Problemlöser •Neutraler Sachverständiger |

|

|

|

|

Consultation as a capacity loan (Economic calculus) |

Consultation as the transfer of experience (Development calculus) |

Consultation as the basis of trust (Objectifying calculus) |

Fig. 2. Tasks, functions, and roles of consultants [10]

An institutional investment consultant provides investment advice to public and private companies, foundations, and endowments looking for help managing their money or the money in their employees' retirement funds. They are used widely in the U.S., Europe, and Australia. Institutional investment consultants offer a wide range of services, including designing retirement plans for large organizations, arranging audits, and providing asset allocation advice.

There are hundreds of consultants around the world that provide an extensive menu of services. The most common services provided by them include:

a. Plan design;

b. Development of investment objectives and investment policy statements;

c. Benchmark selection;

d. Operational audits;

e. Asset allocation advice;

f. Manager selection and monitoring.

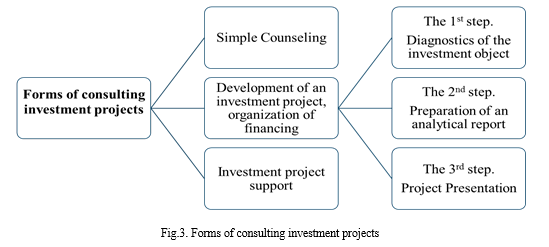

Investment project consulting can take various forms (see Fig. 3).

Simple consulting implies that the client receives consultations upon request, at any stage of the development of the project. Consultants help to resolve the difficulties that have arisen, to give competent advice. They have the necessary expert information for an objective assessment of the situation, creating an optimal scheme for solving the problem.

The second form is the development of an investment project, which includes 3 stages:

- Diagnostics of the investment object. Marketing, competitive, managerial and financial analysis;

- Preparation of an analytical report, which includes a business plan and a strategy for its implementation with milestones to monitor the progress of the project;

- Presentation of the project.

Arranging the financing of investment projects is a fairly large-scale, labor-intensive, lengthy and responsible process for the head of the company and the project. This process is especially difficult for enterprises that do not have experience in the implementation of investment projects.

At the same time, one of the topical issues for the project initiators is the development of optimal financing schemes. It allows you to get a positive net cash flow and balance of funds at each stage of the project and, as a result, ensure the feasibility of the investment project. The help of professional consultants is especially important here.

When drawing up financing schemes, they will help to analyze the adequacy of funds and determine the need for borrowed funds, search for missing funds in the face of their shortage in the financial markets.

Each funding source has both advantages and disadvantages. Therefore, the implementation of any project involves the justification of the financing strategy, the choice of alternative sources and the development of financing schemes.

One of its goals is to provide the most favorable conditions for raising funds. To do this, a project financing model is drawn up, taking into account own and borrowed funds, while taking into account the interests of all participants.

The third form - Project Maintenance implies real-time support of the project. Here, consultants participate in the management and implementation of the project, help optimize the management scheme of the client’s company. This indicates the importance of the mechanism for the effective functioning of both parties.

Thus, the strategic partnership of a consulting organization with a client, where both parties, both the client and the consulting firm are equal partners, is based on long-term cooperation throughout the entire investment process, in other words, throughout the life cycle of a customer's product. In this regard, it is possible, in our opinion, the identification of the concept of “management consulting” with the term “investment consulting”.

Management consultants make management concepts. They invent the basic principles, design methods and instruments, and, that way, solve the problems of their clients. As knowledge transfer is, besides problem-solving, a dominant function of consulting, knowledge is a central parameter in the definition of consulting. Besides law firms, auditing companies, and also investment banks, investment consultants are among professional service firms that perform particularly knowledge-driven services.

The following table-1 provides a chronological overview of the establishment of consulting companies in general and, thus, of the genesis and historical development of investment consulting.

Table-1.

Founding years of important consulting companies [10]

|

Organization |

Year |

Era |

|

Foster Higgins |

1845 |

Origin of consulting |

|

Deloitte |

1849 |

|

|

Pricewaterhouse Coopers |

1849 |

|

|

Sedgwick |

1858 |

|

|

Arthur D. Little |

1886 |

|

|

Ernst & Young |

1906 |

Strategy |

|

Arthur Andersen |

1913 |

|

|

Booz Allen Hamilton |

1914 |

|

|

Buck Consultants |

1916 |

|

|

Hymans Robertson |

1921 |

|

|

A. T. Kearney |

1926 |

|

|

McKinsey & Company |

1926 |

|

|

Towers Perrin |

1934 |

Human Resources Actuary/ Pensions |

|

Russell Investments |

1936 |

|

|

Hewitt |

1940 |

|

|

Hay Group |

1943 |

|

|

Watson Wyatt |

1946 |

|

|

Lane Clark & Peacock |

1947 |

|

|

Mercer Management Consulting |

1959 |

StrategyOperations Management |

|

The Boston Consulting Group (BCG) |

1963 |

|

|

Callan Associates |

1966 |

|

|

Roland Berger |

1967 |

|

|

Cap Gemini |

1968 |

|

|

American Management Systems (AMS) |

1970 |

|

|

Bain & Company |

1973 |

|

|

Wilshire Associates |

1972 |

Actuary/ Pensions Investments |

|

Cambridge Associates |

1973 |

|

|

William M. Mercer |

1975 |

|

|

Aon |

1982 |

|

|

Computer Sciences Corporation (CSC) |

1988 |

Information TechnologyOrigin |

|

Pension Consulting Alliance |

1988 |

|

|

Cambridge Technology Partners (CTP) |

1991 |

|

|

IBM Global Business Services |

1991 |

|

|

Sapient |

1991 |

|

|

The Segal Co. |

1993 |

|

|

Strategic Investment Solutions |

1994 |

|

|

Mitchell Madison Group |

1995 |

|

|

Atos Origin |

1997 |

The above chronology of company foundations includes classic management consultants, consulting companies focused on auditing as well as on pension and investment consultants [10].

Barrons magazine, owned by Dow Jones, has published the list of Top 100 Institutional Consulting Teams in 2022. According to these data, among the top 10 Consulting Teams, 8 companies belong to the USA, and only 2 of them are European companies. It should be concluded that investment consulting is very developed in the USA (Table-2).

Table-2.

Top 100 Institutional Consulting Teams in 2022 by BARRON’S [11]

|

2022 RANK |

2021 RANK |

TEAM |

FIRM |

LOCATION |

KEY ADVISORS |

|

1 |

1 |

Graystone Consulting, The Dobbs Group |

Morgan Stanley |

Indianapolis |

Wm. Craig Dobbs |

|

2 |

N |

Captrust Team New York/Boston |

Captrust |

New York |

Michael Volo, Jeffery Levy, Michael Sanders |

|

3 |

5 |

Cook Street Consulting |

Morgan Stanley |

Greenwood Village, Colo. |

James Russell, Sean M. Waters, Karen M. Robinson |

|

4 |

11 |

Retirement & Investment Solutions |

CBIZ Investment Advisory Services |

Cleveland |

Brian Dean, Anna Rathbun, Christine Dede Ferry |

|

5 |

6 |

Graystone Consulting, Stephans Van Liew & Oiler Group |

Morgan Stanley |

Chicago |

Linda Stephans, Kristina Van Liew, Erik Oiler |

|

6 |

4 |

Graystone Consulting, Raleigh, Wichita, Dallas & Kansas City |

Morgan Stanley |

Raleigh, N.C. |

Lee Morris, Robert Morris, William Hendrix |

|

7 |

33 |

Graystone Consulting, Chicago |

Morgan Stanley |

Chicago |

James Whitney, Michael Sakach, Mary DiChristofano |

|

8 |

34 |

Private Asset Management |

Baird |

Milwaukee |

Michael G. Klein, Philip C. Dallman, Christopher K. Merker |

|

9 |

12 |

Graystone Consulting, Metropolitan D.C. |

Morgan Stanley |

Potomac, Md. |

Robert Scherer, Ross Charkatz, Maureen Shuler |

|

10 |

23 |

Captrust Team Allentown |

Captrust |

Allentown, Pa. |

Jim Edwards, Wes Schantz, Jeff Loehwing |

Conclusion

The transition of a consulting organization to a client-oriented approach to doing business should be carried out in stages. Customer orientation should be reflected not only in the strategy of the consulting organization, but also in the technology of providing consulting services. In particular, a client-oriented technology for the provision of consulting services should include three mandatory elements: learning by doing; support - as an obligatory stage of the consulting process; diffusion of the boundaries of the consulting and client organization [2]. A study of the practice of providing consulting services in Uzbekistan showed that today we have created a website https://www.yellowpages.uz/rubrika/konsalting-uslugi/tashkent, which presents a catalog of organizations and services provided them. There are 264 organizations registered on the site that provide consulting services in customs, tax, legal, accounting, marketing, information, etc. spheres. On the site you can find information about the location of firms, hours of management and phone numbers for communication [12]. As the study showed, there are only a few among them, and these are “Yuldosh Consult” LLC, “Consulting Center Corp Engineering” LLC, “Professional Busines Advisers” LLC is engaged in the provision of financial services and the development of business plans, feasibility studies. Most of the list positions itself most often as firms providing consulting services that do not involve full support until the commissioning of the facility. Judging by its positioning, only “Adamas Consulting Service” LLC is engaged in investment consulting, which provides comprehensive support for investment projects and business consulting; financial and investment management. The site https://top.uz/section/investitsionnyy-konsalting/uzbekistan “Investment consulting in Uzbekistan” provides information about 18 companies [13], whose areas of specialization include, for example, “Korporativ Maslahat Tizimlari” Consulting services, Statistical and marketing research, consulting, Real estate appraisal, Business plans, feasibility studies - development, Financial organizations. “Framework Consulting” Ltd. positions itself as a company providing “Services, Statistical and marketing research, consulting, Accounting services, Consulting services, Extraction and processing of minerals, Financial institutions”. The field of activity of the company “Holos” Ltd. is \"Chemical industry, Customs services, Statistical and marketing research, consulting, Accounting services, Services\". Thus, full coverage and support of the investment project from start to finish is not provided by any of the companies registered on the website, nor by their customers. In fact, today one can notice the incompleteness of the process of formation of practical investment consulting in Uzbekistan, namely: 1) Lack of unambiguous requirements for the training of professional consultants, 2) Duality of assessment by the client and the consultant of the consulting product; 3) Lack of a clear pricing policy for consulting services; 4) The absence of the so-called \"diffusion of boundaries\" of the consulting and client organization. In this regard, we propose to replace three areas in approaches to assessing the effectiveness of management consulting, and these are: a) The effectiveness of the consulting organization as a whole; b) The effectiveness of the consulting organization on the project; c) The effectiveness of the use of the consulting product by the client, a single indicator of the effectiveness of the customer’s project itself (the created product), since the project can only be effective if it is carried out by a team consisting of both consultants and the client organization, where coherence team work is evidence of the level of interaction between project participants in the process of creating a product. Thus, the profit from the sale of the product will act as a criterion for effective (inefficient) interaction between two parties interested in the profit: a consulting firm and a client-customer For this we offer: • Conduct an analysis of the activities of existing consulting firms and evaluate potential options for organizing the activities of professional consultants when interacting with clients; • Work out aspects of strategic partnership in order to increase the competitive qualities of both the client enterprise and the consulting firm with a clear delineation of the functions of the project initiator and consultant; • Develop recommendations for the introduction of new technologies for the activities of consultants.

References

[1] Fritz Steele. Consulting for Organizational Change (Paperback) Published October 28th 1987 by University of Massachusetts Press. Paperback, 208 pages, pp. 2 f. [2] Barcus, J.W. & Wilkinson, W. (Eds.). 1995. What is management consulting? Handbook of Management Consulting Services. Blacklick: McGraw-Hill. [3] ??????????? ?.?., ???????? ?????????????? ????? ??????????? ?? ?????? ????????????? ????? ??????????????? ??????????? ??????????? ??????????? ?? ????????? ?????? ??????? ????????? ????????????? ????. ??????, 2003, ?. 26. [4] ????????? ?.?., ??????????????????? ???????????? ? ????? ?????????????? ?????. ??????????? ??????????? ?? ????????? ?????? ??????? ????????? ????????????? ????. ??????, 2004, ?. 24. [5] ???????? ?.?., ????????????????? ??????????? ?????????????? ????? ? ????? ?????????? ????????? ???????? ????? ? ??????? ???????????. ??????????? ??????????? ?? ????????? ?????? ??????? ????????? ????????????? ????. ?????-?????????, 2005, ?. 22. [6] David H. Maister: Professionalism in Consulting, 2010. p. 36. [7] Arthur N. Turner: Consulting Is More Than Giving Advice, 1982. pp. 121. [8] Bloomfield/ Danieli: The Role of Management Consultants, 1995 p. 5. [9] Biswas/ Twitchell: Management Consulting: A Complete Guide to the Industry, 2002. p. 7. [10] D Runge. The Definition of Investment Consulting including Typology and Segmentation, 2013. p. 4. [11] https://www.barrons.com/advisor/report/top-financial-advisors/institutional?page=1&mod=faranking_subnav_institutional [12] https://www.yellowpages.uz/rubrika/konsalting-uslugi/tashkent. Catalog of organizations and services provided investment consulting. [13] https://top.uz/section/investitsionnyy-konsalting/uzbekistan “Investment consulting in Uzbekistan”.

Copyright

Copyright © 2023 Sabirova Lola Shavkatovna , Shaislamova Nargiza Kabilovna . This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET49272

Publish Date : 2023-02-26

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online